Trading Psychology & Journals: Control Emotions for Profits

Table of Contents

Understanding Trading Psychology

Navigating the world of trading? Then grasping trading psychology is absolutely essential – it’s really the key to consistent profits! It’s incredibly easy for emotions like fear and greed to creep in, often leading to impulsive moves and missed opportunities; we all experience that at some point. The truly skilled traders recognize this powerful influence and actively work to minimize its impact. Think about biases like confirmation bias – seeking out information that confirms what you already believe – or loss aversion, where losses sting far more than equivalent gains. These can easily derail even the most carefully planned strategies.

Becoming self-aware is a huge step toward mastering your emotional responses while trading. A trading journal offers a brilliant way to objectively review past decisions, spot recurring patterns in your behavior, and pinpoint what triggers those reactions. By understanding why you make certain choices, you can develop proactive risk management strategies and ultimately boost your performance.

Common Emotional Biases in Trading

Emotional biases? They’re sneaky roadblocks to successful trading, aren’t they? Take loss aversion, for instance – that urge to hold onto losing trades hoping for a turnaround. Or confirmation bias, where we only seek out information confirming our existing beliefs. These psychological traps can lead to impulsive decisions and missed opportunities.

Beyond those, the anchoring effect (getting stuck on initial data) and herd mentality (following the crowd) are also common pitfalls. Really, understanding these tendencies – a key element of trading psychology – is crucial for developing discipline. A trading journal can be surprisingly helpful in spotting and managing their impact.

Fear of Missing Out (FOMO) & Its Impact

That familiar feeling—Fear of Missing Out, or FOMO—can really throw a wrench into trading plans. It’s like watching everyone else savor something amazing and suddenly craving a taste! This often leads to impulsive decisions instead of following your strategy; a trap many traders fall into. Recognizing these emotions and sticking to your plan is key to avoiding overtrading and chasing fleeting trends, ultimately protecting yourself from potential losses.

Regret Aversion and Hesitation

Ever notice how sometimes we hesitate when trading, worried about missing out? That’s regret aversion at play – a powerful psychological bias. It’s like being overly cautious and letting a good opportunity slip by! Keeping a trading journal helps you spot these patterns and ultimately improve your trading psychology, leading to better decisions.

Overconfidence and Risk-Taking

Feeling like you’re an amazing trader? It’s easy to get carried away, but that overconfidence can blindside you to real risks. Things like the availability heuristic often amplify this, making us think we’re better than we are – potentially leading to bigger bets and more market exposure. To stay on track, be honest with yourself! Keep a trading journal to analyze your decisions objectively and adjust your risk management accordingly; humility is key for lasting success.

Why Emotions Hijack Your Trades

It’s easy for emotions to hijack our trading, often leading to outcomes we don’t want. Ever felt that urge to sell during a dip out of fear? Or maybe chased quick profits with little regard for risk management due to greed? Recognizing these patterns is really important if you want consistent success – it all comes down to understanding your own trading psychology.

Becoming more self-aware is the first step toward gaining control. Keeping a trading journal can be incredibly helpful; jotting down your decisions and how you felt at the time lets you learn from past experiences. Why not start building some disciplined habits today?

The Amygdala's Role in Decision Making

Ever wonder why you make quick decisions, especially when emotions run high? That’s often your amygdala at work! This brain region rapidly assesses threats and rewards – sometimes bypassing logic for an instant reaction. It’s a huge factor in trading psychology, impacting how we perceive risk and potentially triggering impulsive moves. Understanding this connection allows traders to build strategies that reduce emotional biases, leading to more thoughtful choices.

How Market Volatility Amplifies Emotions

Market volatility definitely stirs up emotions for traders – it’s only natural! Those rapid price swings can easily spark fear and anxiety, sometimes leading to impulsive decisions. Conversely, quick wins might trigger a bit of greed, pushing folks toward risky investments before really digging into the details. Really, understanding trading psychology is crucial for staying disciplined and making smart choices.

The Power of the Trading Journal

For traders serious about leveling up their game, a trading journal can be an absolute game-changer. It’s not just about jotting down what you bought and sold; consider it a comprehensive log of your thought process, emotions, and observations while navigating the market. Consistently recording these details allows you to identify recurring patterns – maybe you realize fear or excitement often cloud your judgment. That kind of self-awareness is vital for developing solid trading psychology and discipline, which naturally leads to improved outcomes.

There’s so much value in keeping a journal! You can pinpoint biases, see how effectively your risk management strategies are working, and refine your approaches with actual data. Think of it as a historical record—a chance to learn from both successful trades and those that didn’t go as planned, fueling continuous improvement. Don’t forget to track entry and exit points, market conditions, and even your emotional state; all these factors contribute to making smarter decisions moving forward.

Beyond Record Keeping: Self-Awareness Tool

Keeping a trading journal isn’t just about logging your activity; it’s actually a powerful way to boost self-awareness. Instead of solely focusing on technical analysis, really digging into the psychological side can dramatically improve how you trade. Regularly reviewing those entries helps spot emotional biases and patterns – key pieces in understanding trading psychology.

It’s like taking time to reflect on your choices, not just whether they paid off! Rather than simply noting trades, consider what you were feeling, how you managed risk, and how the market’s shifts affected you. This kind of conscious reflection builds discipline and helps traders manage emotions for better results.

Benefits of Consistent Journaling

Consistent journaling offers amazing benefits for traders—seriously, it’s a game-changer! Regularly writing about your trades allows for honest analysis, highlighting patterns in what truly works. This kind of self-reflection strengthens your decisions and helps you spot biases affecting your trading psychology.

Consider it like having a personal mentor guiding you! A journal builds into an invaluable resource over time, improving risk management and providing historical insights to shape future choices. Why not start journaling today and unlock your full potential?

Identifying Patterns & Triggers

Ever notice how emotions sometimes cloud our judgment when trading? Understanding trading psychology is key to becoming a more consistent trader. A simple way to improve? Keep a trading journal, but don’t just record the numbers—jot down how you felt afterward! Reviewing these entries can highlight patterns and help you make better decisions. Just remember, correlation doesn’t always equal causation. Want to learn more about this fascinating field? Check out behavioral finance here.

Improving Risk Management Decisions

Better risk management really comes down to making smarter decisions—shifting away from hunches and toward data-driven insights. By tracking what’s happened before and keeping an eye on market shifts, traders can objectively assess their strategies and identify potential pitfalls. Tools like scenario planning and stress testing are helpful, as is regularly checking your exposure levels. Understanding behavioral biases is also key; you can learn more about them here: https://www.behavioralfinance.org/.

What to Record in Your Journal (Beyond the Basics)

A really good trading journal is about so much more than just jotting down dates and whether you made or lost money; it’s a fantastic tool for boosting your trading psychology. It’s worth thinking about why you entered each trade – was it based on a solid plan, a response to something in the news, or maybe an emotional impulse? Noting how you felt at the time—excited, anxious, even greedy—along with what was going on in the market (like unusual trading volume or big economic announcements) can uncover some really helpful patterns.

To make your journal even more valuable, track details beyond just the bottom line. Consider things like average trade duration and risk-reward ratios for different strategies; regularly reviewing these metrics helps you identify biases and refine your approach. Curious about managing emotions while trading? This Investopedia guide offers some great insights: https://www.investopedia.com/trading-psychology-4687031

Essential Trade Details

Keeping tabs on essential trade details is crucial for improving your strategy—it’s like a coach studying game film! Really understanding what happened allows you to make better choices. Jotting down entry and exit prices, the volume traded, and those all-important stop-loss/take-profit levels gives you solid data for objective analysis. Here’s what to remember:

- Date & Time of Trade

- Instrument Traded

- Order Type (Market, Limit)

- Entry Price

- Exit Price

- Volume

This kind of disciplined record-keeping really helps with informed decisions and managing trading psychology, too.

Entry/Exit Prices and Times

Want to level up your trading game? A detailed journal is a fantastic tool! Jot down those entry and exit prices – the specifics matter – along with when you made each move. More importantly, capture why you traded; what were you thinking, which indicators did you see? Reviewing this data reveals patterns in your trading psychology, helping you identify biases and fine-tune strategies for better results.

Position Size and Leverage

Finding the right position size really matters when it comes to risk management – a crucial element of successful trading! Many experienced traders aim to risk only 1-2% of their capital per trade, which is a solid strategy for protection. Keep in mind that leverage can amplify both gains and losses, so understanding those risks is key. Doing the math thoughtfully helps prevent significant setbacks and builds disciplined habits for lasting success.

Deeper Insights for Emotional Analysis

Really understanding your emotions is a cornerstone for consistent trading success – it’s about digging deeper than just recognizing feelings like excitement or fear. A trading journal can be incredibly helpful here, acting as a tool to spot patterns and uncover why you make certain choices. Jotting down details after each trade, including your setup and how you felt at the time, can reveal hidden biases impacting your performance. This awareness is powerful; it lets you manage risk better and make more informed decisions. Why not start taking control of your emotions today?

Pre-Trade Thoughts & Expectations

Disciplined trading psychology really hinges on thoughtful preparation. It’s a good idea to quickly note down what you anticipate from a trade – no justifications allowed! This simple step helps manage emotions and keeps things objective. Later, reviewing those notes after each transaction can highlight areas for improvement, ultimately leading to smarter decisions.

Emotions Felt During the Trade (Fear, Greed, Excitement)

Your success in trading hinges significantly on your psychology. It’s easy to let fear push you into selling too soon or allow unchecked greed to tempt you toward risky ventures. Even that excitement after a win can derail your strategy! Recognizing these feelings is truly key for disciplined actions.

Emotions themselves aren’t the problem, but ignoring them—particularly fear and greed—can be quite costly. A trading journal proves invaluable; it helps identify patterns and lessen emotional biases, ultimately leading to more consistent outcomes.

Market Conditions & Context

Today’s market demands a thoughtful approach – it’s definitely intricate! Macroeconomic factors like inflation and interest rate hikes significantly impact investor sentiment. At the same time, innovative industry trends and evolving consumer tastes present exciting opportunities alongside potential risks for traders. Really understanding this dynamic is crucial for making sound choices.

- Volatility remains high due to global uncertainties, so risk management is key. Analyzing these broader forces helps us stay objective and avoid emotional trading traps – keeping a detailed journal can reveal those biases.

Analyzing Your Journal for Emotional Patterns

Ever wonder why some trades go south? Analyzing your trading journal can be a surprisingly powerful way to boost your trading psychology. It’s more than just jotting down what happened – consider it like being a detective, really! Don’t just list the trades themselves; instead, actively look for those recurring emotional patterns. Rather than dwelling on individual events, try spotting patterns—those consistent triggers that reliably spark feelings like fear, greed, or regret. These are vital clues to address.

Understanding how emotions influence your decisions is key. It allows you to develop strategies and ultimately minimize their negative impact on your trading performance.

Identifying Recurring Triggers

Ever wonder why emotions sometimes hijack your trading? Understanding trading psychology is key! Think of a trading journal as your personal detective – it helps you spot those patterns that trigger reactions. Rather than just jotting down how you felt, like anxiety, try recording the specifics: did you find yourself constantly checking a trade, for instance? These objective details offer real insights and can lead to much smarter choices.

Recognizing Fear-Based Decisions

It’s really important to spot when your decisions are driven by fear if you want consistent success with trading psychology. Emotions can easily take over – think about panic selling; it’s often an impulsive reaction rooted in worry. Noticing those emotional signals, like a sudden feeling that you need to get out of a trade, is the first step toward regaining control and making smarter choices.

Spotting Overconfidence in Winning Streaks

It’s easy to get carried away when you’re on a winning streak, isn’t it? Sometimes those successes can lead to overconfidence, causing traders to take unnecessary risks—even when the market is hinting otherwise. Really understanding this psychological tendency is vital for lasting success; don’t let past wins cloud your judgment! To help manage that, regularly review your trading journal and honestly evaluate how you’re doing. Focus on process, not just outcomes. Acknowledge potential biases and adjust your strategy accordingly—smaller position sizes during winning periods can be a good idea.

Common Behavioral Biases Revealed Through Journaling

Ever wonder why your trades sometimes go sideways? Journaling can be a surprisingly helpful tool for understanding trading psychology. It’s about regularly jotting down your decisions – the ‘why’ behind them is key. You might notice patterns, like confirmation bias (favoring info that confirms what you already think). Spotting these biases through journaling lets you consciously challenge them! Try actively seeking out evidence that disagrees with your initial ideas; consistent self-reflection really does lead to more objective choices and ultimately, better trading outcomes. Ready to take control? Start a journal today!

Confirmation Bias and Selective Memory

Ever notice how we tend to gravitate towards information that already feels familiar? That’s confirmation bias at play! It can creep into trading, too, fostering overconfidence and making us ignore important signals. Honestly assessing ourselves is vital – a detailed trading journal helps immensely. Reviewing past trades, both good and bad, and actively seeking out data that challenges your beliefs will really boost your trading psychology.

Anchoring Bias and Initial Price Fixation

Anchoring bias significantly impacts trading psychology – it’s similar to holding onto a first impression. Ever notice how seeing a stock initially at $100 might make $95 seem like a great deal? That’s anchoring in action! Recognizing this anchoring bias is crucial for better decisions. Actively seek out diverse data and challenge those instinctive reactions; keeping a trading journal can really highlight its influence, ultimately leading to more objective choices.

Strategies for Emotional Control (Based on Journal Insights)

Ever wonder why some trades go south, even when the logic seemed sound? Often, it boils down to how we react emotionally as markets move. Many traders find themselves reacting impulsively after a loss or getting carried away with wins – it’s a common pitfall! The good news is that analyzing your trading journal can unlock powerful strategies for emotional control and significantly improve your results. For example, if you notice frustration creeping in with smaller losses, setting pre-defined stop-loss orders could help curb those emotionally driven decisions.

Think about identifying what sparks those reactions in the first place. Solid risk management protocols are also essential, as is practicing mindfulness to become more aware of your feelings. Regularly reviewing your journal allows you to continuously tweak these strategies, building discipline and objectivity – a true key to mastering trading psychology.

Mindfulness & Self-Awareness Techniques

Finding consistent success in trading often hinges on cultivating mindfulness & self-awareness. Think of focused breathing as a quick reset—it’s surprisingly helpful for calming down during those wild market swings! Regularly practicing techniques like body scans can really improve your ability to observe thoughts without getting caught up in them, leading to more rational choices.

A trading journal is an excellent tool; tracking your emotions alongside your trades helps you spot patterns and biases that might be impacting your performance. Sometimes, just pausing for a moment before clicking ‘buy’ or ‘sell’ can make a big difference to your trading psychology and risk management.

Recognizing Early Warning Signs of Emotional Trading

It’s really important to notice early signs of emotional trading if you want consistent success. Trading psychology often shows impulsive decisions stem from habits like staring at screens too long, chasing losses, or ignoring your risk management plan – things we all do sometimes! Recognizing these patterns can help you step back and regain control before emotions start affecting your trades.

Taking Breaks to Regain Perspective

Emotional control is absolutely vital when you’re trading – it’s really the cornerstone of success! Sometimes, stepping back isn’t a weakness; consider it like hitting a reset button. Taking breaks can help you regain perspective and avoid those impulsive choices driven by fear or greed. A little distance allows for clearer analysis, which ultimately reduces risk in trading.

Predefined Trading Plans & Rules

Successful trading really hinges on having a solid plan – consider it your personal roadmap! These structured approaches are incredibly helpful because they reduce those impulsive decisions we all make sometimes by providing clear guidelines for entering and exiting trades, plus managing how much you risk. Risk management is absolutely key; your plan should outline where to set stop-losses and profit targets to protect your capital while still aiming for gains. Keeping a record of your plan, whether it’s in a spreadsheet or even just a journal, helps keep you accountable. Trading psychology tends to improve with this kind of discipline, allowing you to objectively review what’s working and tweak your strategies.

Developing a Clear Entry/Exit Strategy

Consistent trading profitability really hinges on having a solid entry and exit strategy – knowing precisely when to jump in and out is crucial! Sticking to these plans with discipline minimizes those emotional decisions, which are a big part of trading psychology. Plus, don’t forget risk management; keeping a journal can help you spot biases and refine your specificity over time.

Implementing Stop-Loss Orders and Risk Management Protocols

Managing risk is key, and stop-loss orders are often part of the equation. A good starting point? Consider market volatility – the Average True Range (ATR) can help with that. You might also want to explore trailing stops to lock in profits as your trades go well. It’s important to regularly review and adjust those levels, keeping an eye on the current market conditions and your overall plan. Remember to tailor stop-loss placement to your comfort level and strategy – adapt proactively!

Adapting Your Strategies Based on Journal Analysis

Want to level up your trading? Regularly reviewing your trading journal is surprisingly powerful. It’s like having a coach pointing out what’s working and where you stumble – spotting patterns in wins and losses. Maybe news releases consistently lead to bad trades; perhaps it’s time to sit those out! Plus, noticing emotional reactions can highlight areas for better risk management—smaller positions or tighter stops might help. Consider your journal a personal feedback loop designed to sharpen your trading psychology and ultimately improve performance. Why not start journaling today?

Leveraging flows.trading for Enhanced Journaling

For traders constantly looking to refine their approach, flows.trading offers a seriously streamlined journaling experience! The integrated features really make a difference – especially the automated trade capture. It’s like magic; trades are automatically recorded, eliminating that tedious manual entry and cutting down on potential errors. You can even add custom tags to each trade—maybe noting the strategy you employed, current market conditions, or even your mindset at the time. That last bit is surprisingly important for understanding trading psychology. And with flows.trading’s powerful search capabilities, pinpointing past trades based on those tags becomes a breeze, making performance analysis and pattern recognition much simpler.

Customizable Fields for Detailed Tracking

Want a truly personalized way to track your trades? Customizable fields in a trading journal offer just that – it’s like building the ideal tracking system! You can use various field types—text, numbers, dropdown menus, and dates—to capture exactly what you need. This flexibility lets you adapt the journal to fit your specific strategies or instruments. Detailed tracking with these customizable fields really helps analyze your trading psychology, spot patterns, and refine your decision-making for better results.

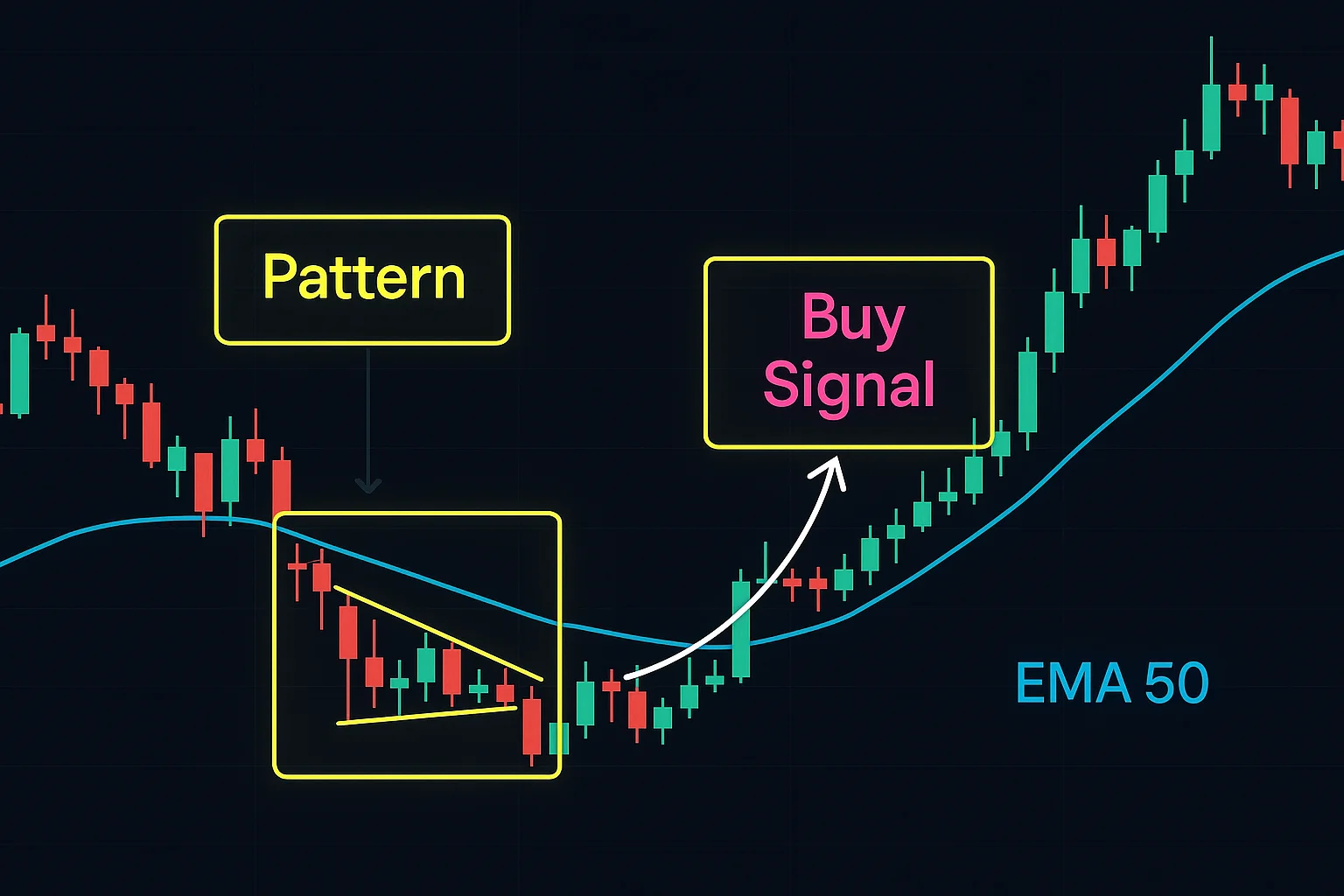

Automated Analysis & Pattern Recognition

The way we trade is changing rapidly thanks to automated analysis and pattern recognition! These tools are incredible – they can quickly analyze massive datasets, uncovering trends and unusual activity that would simply be beyond human capability. Think of backtesting as a way to objectively refine your strategies, minimizing those emotional decisions that can sometimes derail us.

It’s all about saving time and making smarter choices. Pattern recognition algorithms highlight potential opportunities or risks, helping guide entry and exit points with greater confidence. Ultimately, automation fosters a data-driven mindset, improving trading psychology.

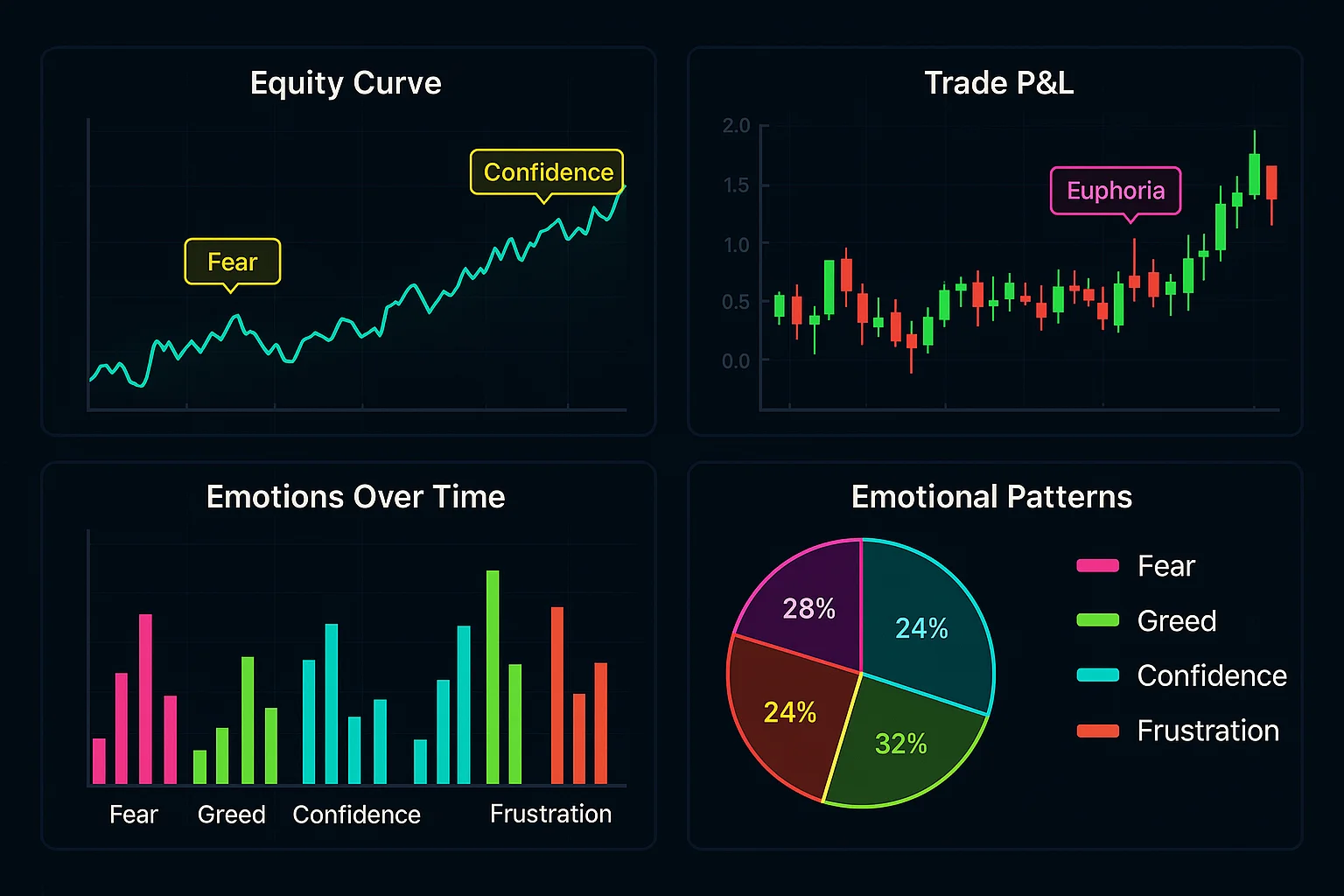

Visual Insights & Performance Dashboards

Understanding trading psychology can be tricky, right? Think about it – sifting through endless spreadsheets isn’t exactly inspiring. But what if you could transform that data into a clear, easy-to-understand chart? That’s the power of visual insights! Charts and graphs help us spot patterns we might otherwise miss, leading to smarter trading choices. Plus, performance dashboards give you an instant snapshot of your portfolio – perfect for making quick tweaks when needed. Why not start journaling your trades now and unlock the potential of visual analytics?

Conclusion

Keeping a consistent trading journal really is an incredibly valuable asset – it’s amazing how much it can improve both your mindset and overall performance. When you carefully document each trade, including the reasons behind it, how you were feeling at the time, and what ultimately happened, you begin to notice patterns in your behavior. It’s kind of like keeping a diary for your trading; that helps reveal those biases and emotional triggers that might be affecting your judgment.

Regular journaling encourages a more data-driven approach, allowing you to analyze trades objectively and recognize recurring patterns. Ultimately, this leads to better control over emotions and more disciplined decisions – potentially boosting profitability! Give it a try; it can really impact your future trading success.

Recap: Emotional Control is Key to Trading Success

It’s no secret that emotional control is absolutely crucial for trading well! Letting fear or greed take over often leads to rash choices and missed opportunities. Really, consistent profits hinge on disciplined risk management and clear thinking – things easily disrupted by unchecked emotions. To get better at this, becoming more self-aware is a great first step; keeping a trading journal and regularly reviewing your trades can highlight those emotional biases impacting your performance. Ultimately, mastering trading psychology helps you make smarter decisions and improves your chances of long-term success.

The Long-Term Value of Consistent Journaling

Consistent journaling really does offer some amazing long-term benefits—it’s more than just reviewing your trades. Taking the time to jot down your thoughts and feelings about those decisions provides valuable insights into your trading psychology, almost like having a mirror reflecting it back at you! This practice builds self-awareness, helping you identify biases and emotional triggers that might be impacting your performance. It’s truly a powerful tool for growth – why not give it a try?