Analyze Your Trades: A Complete Trading Journal Guide

Table of Contents

Why Trade Analysis Matters

Want to consistently boost your trading profitability? Then mastering trade analysis is absolutely essential – it’s truly the key to long-term success! It’s about so much more than just looking at whether you won or lost; consider it a thoughtful exploration into why those trades played out as they did. Really effective trade analysis helps you identify patterns, tweak your strategies, and make better choices moving forward. By carefully reviewing entries, exits, risk management, and what the market was doing, you’ll gain some incredibly valuable insights into how you’re performing.

Skipping this step can be risky; biases often sneak in and lead to repeating the same errors. Keeping a trading journal – whether it’s a digital app or a good old-fashioned notebook – makes analyzing your trades much simpler. Tracking things like win rate, average profit/loss, and drawdown gives you a clear view of what you do well and where you can improve. Ultimately, consistent trade analysis empowers you to become a more disciplined and successful trader.

Identifying Strengths and Weaknesses

Knowing what you do well – and where you stumble – is key to growing as a trader. A good trade analysis, often kept in a trading journal, can really shine a light on those patterns. Rather than just saying ‘I need to be better,’ try identifying exactly what’s happening with your entries, exits, and how you manage risk. It’s about finding that balance between successes and areas for improvement; it gives you a clear picture so you can tweak your strategy and boost your trade analysis.

Recognizing Consistent Patterns in Winning Trades

Finding those reliable patterns in successful trades is really important for long-term growth, right? A trading journal can be a game-changer—it’s like reviewing your game film to see what works! Focus on how you approached each trade: entry and exit points, risk management, even the market conditions. Don’t just look at whether you won or lost; quantify those patterns with win rates and timeframes. Solid trade analysis unlocks valuable insights for making smarter choices.

Pinpointing Recurring Errors in Losing Trades

Spotting recurring errors from losing trades is really important for consistent growth. A detailed trading journal can be surprisingly helpful – it’s like finding the connection between what might seem like random events. Analyze your entries honestly, avoiding vague notes that ultimately hinder progress. Think of these mistakes as opportunities to learn and build a stronger, more resilient trader mindset.

Improving Trading Strategy

Let’s talk about fine-tuning your trading strategy – it’s a really worthwhile process! Begin by digging into your trading journal; take a close look at when you got in and out of trades, and what the market was doing then. Spotting those patterns—the wins and the losses—can highlight where adjustments are needed. Ultimately, data-driven tweaks like better stop-loss placement or refining risk/reward ratios can really boost your success.

Managing Risk Effectively

For traders of all levels, effective risk management is absolutely vital. It’s really about identifying those potential threats to your capital and then crafting strategies to minimize their impact—it’s not always about avoiding risks altogether! By focusing on lessening them, you can stay engaged in the market while safeguarding against significant losses. A regular review process proves key to long-term success.

Consider practical techniques like stop-loss orders and diversifying your investments. Plus, analyzing past performance is a must. Keeping a detailed trading journal—recording those entries, exits, and trade analysis—can really improve future decisions. Why not start honing your risk management skills today?

Essential Metrics to Track

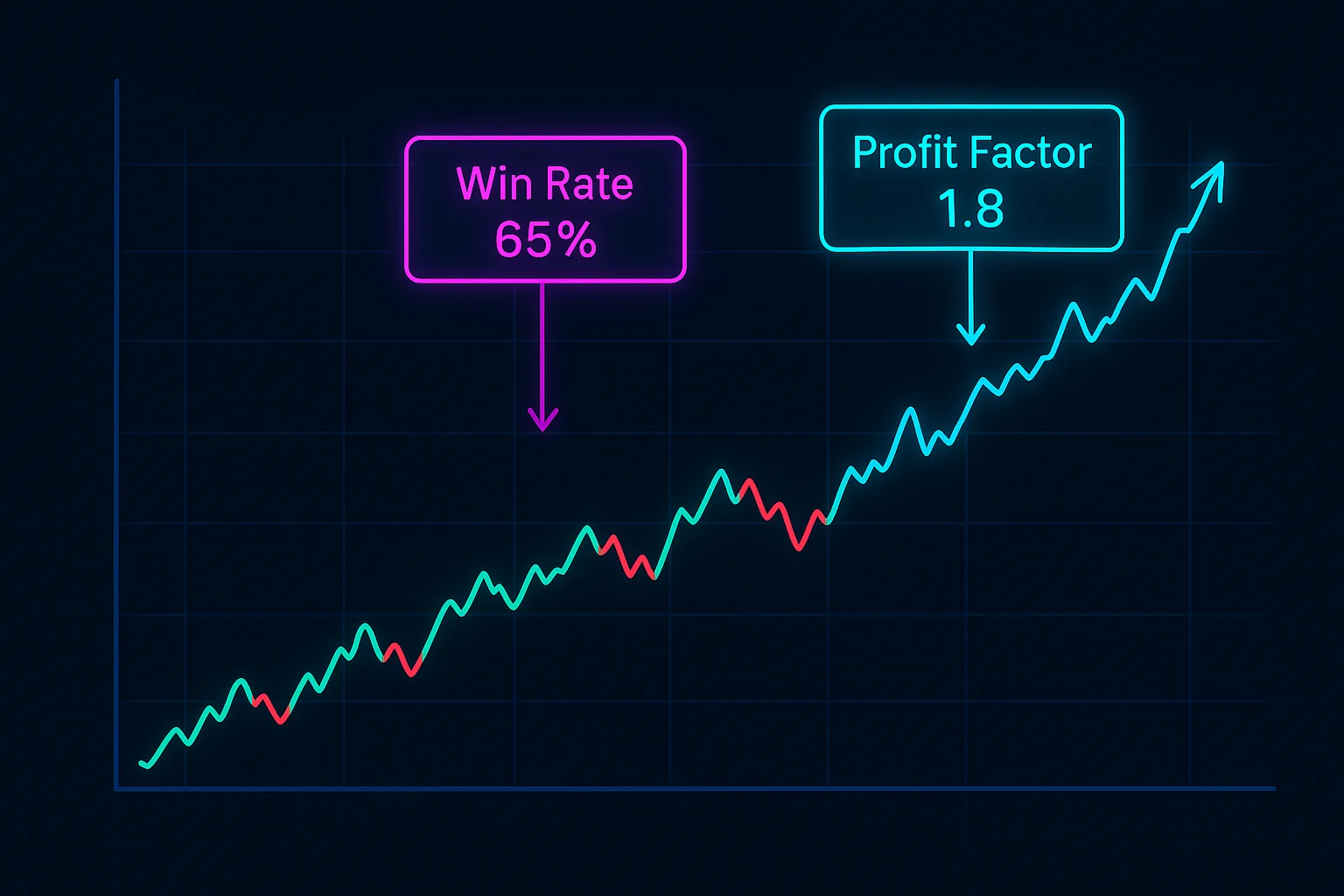

Want to level up your trading game? A trading journal is honestly one of the best tools you can use. It’s all about understanding what’s working and, just as importantly, what isn’t. Start by tracking some key numbers – like your win rate (how often you profit), average gains, and losses per trade. These give you a good feel for your risk-reward balance and whether you’re actually making money!

Don’t forget to keep an eye on drawdown too; that shows how much your account dips during losing streaks. Plus, think about how often you’re trading and how long it takes – streamlining those can really improve efficiency. Ultimately, this data helps move beyond guesswork and towards smarter trade analysis.

Win Rate: Calculating and Interpreting

Figuring out your trading strategy’s effectiveness often comes down to one key metric: the win rate. It’s pretty straightforward – just divide your winning trades by your total number of trades. For example, if you have 20 wins from 50 attempts, that’s a 40% win rate. Understanding your win rate gives you valuable insight! A rate dipping below 30% could mean you’re being too aggressive or need to rethink things; most traders aim for around 40-60%. Don’t automatically assume a high win rate (above 60%) is always better – make sure your risk management can handle potential setbacks.

What's a "Good" Win Rate?

A solid trading strategy and current market conditions heavily influence your win rate. You know, even a lower percentage—say, 35 to 45%—can work out well if you’re chasing substantial profits. Many traders average around 50-60%, but consistently high rates above 65% might suggest being overly careful. Really, risk management takes precedence; factors like trade size and volatility matter just as much. Consistent analysis is key to navigating these situations.

Profit Factor: Understanding Return on Investment

Knowing your Return on Investment (ROI) is really important for gauging how profitable something is. It’s a pretty simple calculation too – just divide the profit you make by what you initially invested and then multiply that number by 100. For example, if you made $50 from a $200 investment, your ROI would be 25%! This helps you see how well your money is working.

Plus, keeping track of things consistently is crucial for making good choices. A trading journal lets you look back at what you’ve done, tweak your strategy, and hopefully minimize losses while maximizing gains – effective trade analysis really does pay off!

How to Calculate Profit Factor

Understanding your trading strategy’s effectiveness hinges on calculating the Profit Factor. Simply put, it’s total profits divided by total losses – think of earning $10,000 while only risking $2,500; that yields a fantastic Profit Factor of 4! A value above 1 generally suggests you’re on the right track, and higher numbers mean even better results. It’s always wise to review this alongside other data for a truly complete picture.

Risk-Reward Ratio: Maximizing Gains While Minimizing Losses

Understanding the risk-reward ratio (RRR) is key to smart trading! It’s a simple way to gauge potential gains against possible losses – essentially, how much you stand to earn for every dollar risked. A favorable RRR, like 2:1 or even 3:1, suggests a potentially lucrative opportunity. For instance, a 3:1 ratio means you could see three times the profit compared to your risk. It’s all about balance; a 1:1 ratio offers equal footing. By consistently analyzing RRR, traders can protect their capital and prioritize trades with strong return potential. https://www.investopedia.com/terms/r/riskrewardratio.asp provides more details.

Ideal Risk-Reward Ratios for Different Strategies

Finding the right balance is crucial for successful trading, and that often comes down to understanding risk-reward ratios. For example, quick scalping strategies might aim for a 1:1 or 1:2 ratio, while swing traders – those holding positions longer – could target 1:3 or even higher. Day traders frequently use a 1:2 ratio for faster gains. Keeping a detailed trade analysis, perhaps in a trading journal, can really help you fine-tune these ratios based on your results and what’s happening in the market. Want to learn more about risk management? Check out this helpful resource https://www.investopedia.com/terms/r/riskrewardratio.asp.

Average Trade Duration: Analyzing Time in the Market

Ever wondered how long investors typically hold onto their trades? Examining the average – or mean – and middle point, the median, can offer some fascinating insights into investor behavior. A short holding period might indicate a focus on quick gains through scalping, while longer durations often suggest swing or position trading strategies. Thinking about this data in relation to your own approach is worthwhile; for example, consistently brief average trade times could mean you’re day trading.

Drawdown: Measuring Peak-to-Trough Loss

Understanding drawdown is key for any trader – it reveals the biggest drop in an investment’s value, essentially showing you the steepest hill you might face. It’s different from total loss; instead of considering everything that could go wrong, drawdown focuses on your largest percentage decline. This gives a good sense of potential volatility and helps prepare for worst-case scenarios. Keeping track of drawdown alongside your trading journal can really improve your performance – tools like flows.trading can make trade analysis much easier!

Beyond the Numbers: Qualitative Analysis

It’s easy to get caught up in the numbers when evaluating our trades – win rates, profit factors, you name it. But digging deeper with qualitative analysis really unlocks a better understanding of why things happen. It’s about more than just whether you won or lost; it’s exploring the context surrounding each trade and the decisions that led to it. Consider your emotions at the time, any external influences, and even the initial reasoning behind your strategy.

A detailed trading journal becomes invaluable here. Rather than simply recording outcomes, document why you made those choices – adjustments you considered, lessons learned from both wins and losses. This kind of thorough trade analysis provides a clearer path toward targeted improvements and ultimately, better trading performance.

Recording Emotions and Psychology

Creating relatable characters brimming with genuine emotions? It really comes down to the little things. Think about it: instead of telling us a character is sad, show us – maybe they’re nervously fiddling with their hands or staring out a window. Digging into those underlying motivations adds so much depth; sometimes what’s visible isn’t the whole story! And please, let’s avoid tired clichés—specific details are what truly make your characters feel real.

Identifying Emotional Triggers

Ever notice how certain situations just set you off? Understanding your emotional triggers is a fantastic step toward greater self-awareness and managing those reactions more effectively. Try to recall specific moments when strong feelings arose – times you felt truly upset, for example. Using ‘I statements,’ such as ‘I felt anxious when…‘, can really personalize this process. Grouping these triggers—maybe interpersonal conflicts or environmental stressors—provides valuable insight into who you are.

Managing Fear and Greed

Navigating the trading world? It’s all about managing those tricky emotions – fear and greed! Relying solely on market analysis isn’t enough; behavioral techniques are vital. We’ve all been there: fear prompting a sell-off too soon, or greed leading to overspending. A long-term view can really help keep your trading disciplined.

Documenting Market Conditions

Knowing what’s happening in the market is crucial for making good choices, right? We focus on real data—no guessing games here. Our team closely monitors things like interest rates, inflation, and unemployment to get a clear picture of where the economy stands. Plus, accurate documentation really helps us plan strategically.

We keep thorough records, always showing our sources for all stats, so everything’s transparent. That includes looking at commodity prices and what investors are feeling; understanding these factors is key for solid trade analysis.

Capturing Setup Rationale & Entry/Exit Points

Really diving into a trading journal goes beyond simply noting what you bought or sold; it’s about uncovering why you did it! Jotting down the reasoning behind each trade – whether it was a technical signal or something fundamental – can really illuminate your choices. Be sure to clearly define those entry points, like specific price levels, and map out exit strategies in advance, including where you’ll take profits and set stops. Consider using trailing stops too; they’re fantastic for boosting gains while keeping risk in check. This kind of detailed trade analysis unlocks some truly invaluable insights to help refine your strategy.

Post-Trade Reflections: Lessons Learned

Reflecting on your trades – both the successes and setbacks – is truly essential for consistent growth in trading. It’s easy to miss valuable patterns when you’re caught up in the moment, but taking time to review them can be incredibly insightful. Think of it like reviewing game film; a detailed trading journal allows an objective look at your strategy, risk management, and emotional control. Be honest with yourself – avoiding mistakes just slows down learning! Consider entry/exit points, position sizing, and what market conditions were present. Pinpointing recurring errors provides actionable steps to refine your approach and improve future results. Ready to level up? Start analyzing your trades today!

Common Pitfalls in Trade Analysis

It’s surprisingly easy to fall into traps when you’re doing trade analysis, isn’t it? A common one is confirmation bias – we all tend to seek out information that confirms our existing beliefs, while conveniently ignoring anything that challenges them. Think of it like trying to predict the future based on just a couple of trades; it’s rarely accurate! And don’t overlook those often-forgotten transaction costs—commissions and slippage can really eat into your profits. Really good trade analysis requires a clear head and a well-thought-out plan.

To help avoid these pitfalls, I suggest keeping a detailed trading journal of every decision you make, along with the outcome. Regularly reviewing key metrics like your win rate and average profit/loss is crucial – be honest with yourself! Tools like flows.trading can simplify this process. Consistent self-assessment really helps you spot weaknesses and refine your strategies.

Focusing on Individual Trades vs. Patterns

To really level up your trading, it’s helpful to analyze things in a couple of ways. First, take a close look at each trade – when you got in, when you got out, and why you made those choices. This kind of self-reflection can quickly highlight areas for improvement.

Beyond that, consider the bigger picture: market patterns like support and resistance. These offer valuable context and hints about what might happen next. Combining both approaches is where trade analysis really becomes powerful; individual trades teach you about patterns, and those patterns help guide your future decisions – they work together!

Confirmation Bias: Avoiding Self-Deception

Ever notice how easy it is to stick with what you already know? That’s kind of like confirmation bias – a mental shortcut where we tend to favor information that confirms our existing beliefs. This can really impact trade analysis, potentially leading to less-than-ideal trading choices. To get better, try actively seeking out different viewpoints and questioning your assumptions! A detailed trading journal, documenting the reasoning behind each trade, is a fantastic way to spot patterns and biases.

Strategies to Mitigate Confirmation Bias

It’s a challenge, but overcoming confirmation bias really does come down to mindful effort. Think of it like this: actively seek out evidence that challenges your existing beliefs – look at both sides! Exploring different perspectives and honestly assessing why you think what you do is crucial before making any decisions. Keeping a trading journal can be incredibly helpful, providing an objective record of your results. Plus, consider devil’s advocacy or trade analysis by diversifying where you get information.

Neglecting Psychological Factors

It’s easy to get caught up in charts and numbers, but overlooking the psychology behind our decisions can seriously hinder trade analysis. Things like confirmation bias or even FOMO often push us toward quick choices we later regret. This impacts capital and confidence—both crucial for lasting success. A simple way to improve? Keep a trading journal; note not just what’s happening in the market, but also how you’re feeling during each trade. Recognizing these patterns can help build strategies that sidestep those psychological pitfalls.

Link to flows.trading's article on common journaling mistakes

Using a Trading Journal Effectively (with Flows)

Want to level up your trading game? A trading journal really can be a secret weapon for consistent growth! It’s not just about jotting down wins and losses—think of it as having a personal coach right there with you. Really effective journaling means digging into why you made each trade, how things went during execution, and what lessons you picked up along the way. Try documenting your thought process behind setups, exactly where you got in and out, risk management strategies, and even how emotions were playing a role. Forget complicated theory for now; instead, focus on those specific observations—the concrete details that offer real learning opportunities. That practical approach is honestly what unlocks truly effective trade analysis.

Tracking Metrics with Flows.trading

Flows.trading is designed to help traders like you really understand their performance. We offer powerful visualization tools for trade analysis, making it simpler to keep an eye on what matters most. Think of our flow visualizations as a clear picture of your win rate, average profit/loss, and how your drawdown changes over time – all at a glance!

It’s easier than ever to spot patterns and see where you might tweak your strategy. For example, using Flows.trading’s charts can quickly reveal correlations between entry signals and outcomes; noticing a consistently lower win rate with one indicator? That’s valuable insight for improving trade analysis.

Automated Calculations and Reporting

Automated calculations really speed things up – algorithms quickly process trade data to instantly generate key performance indicators like profit/loss ratios and win rates. This approach minimizes those pesky manual errors and gives you real-time insights into your trading strategies. Plus, dynamic reports are created based on exactly what you need, whether it’s a weekly P&L report or an asset class analysis. You’ll see example outputs like charts highlighting trends and tables summarizing statistics – making trade analysis much simpler.

Tagging Entries for Categorization

Really effective trade analysis begins with thoughtfully tagging each entry in your trading journal. It’s all about consistency – using the same terms every time to keep things organized and accurate. Think of it like neatly labeling boxes; detailed tags unlock valuable insights into how you’re performing, revealing patterns and areas ripe for improvement.

Proper tagging makes filtering and analyzing trades much easier, helping you spot winning strategies and identify those recurring errors. Ultimately, a well-structured system built around tags forms the bedrock of informed trade analysis.

Utilizing Tags for Strategy Analysis

Want to really understand your trades? Using tags in your trading journal is surprisingly helpful for trade analysis. It’s like adding labels – grouping similar trades by strategy or the assets involved. You might notice a pattern, such as ‘Breakout’ and ‘EURUSD’ consistently working well! Smart tagging helps you make better decisions and identify what to tweak, ultimately improving your trading.

Visualizing Performance Trends

Seeing how your trades are performing? That’s crucial for any trader! Charts and graphs make it so much easier to spot patterns, whether you’re just starting out or an experienced pro. Good visuals—clearly labeled with the right chart types—can unlock some really valuable insights quickly. It spotlights important changes, letting you adjust your strategy proactively. Trade analysis gets a big boost from this kind of approach; tools like flows.trading can streamline things and give you a deeper look at what’s happening.

Charts & Graphs for Quick Insights

Traders, you know how valuable quick insights can be! Charts & Graphs really shine here – they take complicated data and turn it into visuals that are super easy to understand. Focusing on clarity is key; well-labeled axes and the right chart type make all the difference. Effective visualization speeds up decisions—consider bar graphs for comparisons or line charts to track trends over time. Clear presentation helps avoid errors and unlocks your data’s full potential.

Specific Workflows within flows.trading: Example Scenarios

Analyzing trades doesn’t have to be a chore! flows.trading makes it easier with adaptable workflows designed to fit your style. For instance, picture a ‘Risk Management’ system that instantly flags any trade pushing past your stop-loss – peace of mind, right? Or how about a ‘Profitability Assessment’ workflow, quickly calculating ROI and comparing it to what you’ve seen before? It’s fantastic for backtesting or fine-tuning just how much you invest. Ready to streamline trade analysis and see better results? Check out flows.trading today!

Actionable Steps & Next Steps

Want to level up your trading game? It all starts with a few simple steps. First, get into the habit of recording every trade – consider it your personal trading diary. Jot down the details: when you got in and out, why you made those moves, and even how you were feeling at the time. Then, crunch some numbers like your win rate and average profit/loss. This initial data provides a great starting point for trade analysis.

Regularly reviewing this journal – maybe weekly or bi-weekly – helps you spot patterns and tweak your strategy. Tools like flows.trading can make that review process much easier, too! Finally, set some clear goals (like bumping up your win rate by 5%) and consistently track your progress. Seriously, start journaling today; it’s the foundation of disciplined trading!

Start or Refine Your Journaling Practice Today

Want to level up your trading? Starting or improving your trading journal doesn’t have to be overwhelming! Even just a few minutes daily can make a big difference. Consider simple questions like, ‘What was my risk tolerance today?’ or ‘Did emotions influence my decisions?’ You’ll quickly discover valuable insights into your mindset and how effectively your strategy is working.

Here are some helpful tips:

- Objectively record both wins and losses.

- Look for patterns in your behavior – we all have them!

- Identify areas where you can improve, but be kind to yourself. A well-maintained trade analysis journal really is a powerful tool for continuous growth.

Regularly Review and Analyze Your Data (Weekly/Monthly)

Consistent review and analysis of your trading data – whether it’s a weekly check-in or a monthly deep dive – is really important for long-term success. Think about it like keeping an eye on your car’s engine; focus on actionable insights from each trade! Spotting patterns and areas where you can improve becomes much simpler with this habit, letting you adjust strategies and boost performance over time.

Using clear visuals and highlighting key metrics in your trade analysis is a great idea too. A well-kept trading journal—tools like flows.trading offer some fantastic options—provides invaluable data for smarter decisions and refining your approach.

Identify One Area to Improve Each Month

Want to see better results in your trading? Consider dedicating time each month to personal growth. It’s really helpful! Maybe focus on something like risk management or understanding market psychology – just one thing at a time. This keeps things manageable and allows for steady progress.

Take a moment at the end of each month to see how you’re doing, and don’t be afraid to adjust your approach. Consistent trade analysis using this method can really build a strong foundation for long-term success – and better trading overall.

Experiment with Different Metrics and Analysis Techniques

Really boosting your trade analysis goes beyond just tracking wins and losses, doesn’t it? It’s about digging deeper – considering things like the average size of your trades and how much you risk on each one. The risk-reward ratio is a great tool too; it shows potential profit compared to possible loss. Looking back at your trading history with techniques like cohort analysis can also uncover helpful patterns over time, highlighting what’s working well and where you could improve. Ready to refine your strategy? Let’s explore some advanced tools!