Top 5 Trading Journal Apps in 2025: Reviews & Comparisons

Table of Contents

Why Trading Journals Matter in 2025

Looking ahead to 2025, even with all the incredible advancements in trading platforms and algorithms, trading journals will still be absolutely essential for sustained success. It’s true that technology evolves rapidly, but really grasping why you make those choices – that’s a uniquely human element. Journals provide an invaluable space to record more than just the basics like entry/exit points and profit/loss; they capture your emotional state, market analysis, and overall strategy—things automated systems often miss entirely! This self-reflection is key to spotting biases and refining your approach.

Down the road, trading journals might even incorporate AI to help identify patterns and analyze data, perhaps pointing out recurring errors or profitable setups. But at their heart, documenting your thought process will remain vital. You can quickly log important details using bullet points like market conditions or risk tolerance, and always consider potential improvements. Numbered lists (1. Strategy Used 2. Emotional State 3. Outcome) offer structured analysis, fostering continuous improvement and ultimately boosting trading performance.

The Evolution of Data-Driven Trading

The story of data-driven trading really begins back in the 1980s with fairly basic statistical approaches – things like identifying simple patterns from historical prices. Then, as computers got more powerful and market data became readily available, algorithmic trading took off in the ’90s, automating trades according to pre-defined rules and significantly improving efficiency. Today, machine learning is completely reshaping strategies! You’ve got high-frequency trading leveraging massive datasets for lightning-fast decisions, and even sentiment analysis incorporating news and social media—it’s a field that’s constantly changing.

Common Pitfalls Without Journaling

It’s surprising how many traders find it tough to identify recurring errors or recognize lost chances—it really feels like navigating a maze without any light! Without regularly reviewing your trades, stress can easily build up, clouding your judgment and affecting those crucial decisions. And honestly, how will you know if your strategy is actually effective unless you’re tracking its performance? A trading journal provides seriously valuable insights to help you improve.

Emotional Decision Making

Trading can be surprisingly emotional! Sometimes, fear or excitement pushes us toward impulsive actions, pulling us away from our planned strategy. Recognizing those emotional triggers is vital for staying disciplined and making sound decisions. Cognitive biases, like loss aversion, can amplify this influence too.

Fortunately, trading journal apps offer a helpful solution. They let you objectively review your choices and track emotions alongside each trade, boosting self-awareness and revealing patterns that might be holding you back.

Lack of Pattern Recognition

Missing pattern recognition can really hold back successful trading, doesn’t it? Think of it like overlooking clues in a puzzle – you might miss important price shifts or connections between different assets. This often leads to rushed decisions and higher risk. That’s why consistent journaling is so valuable; it helps traders identify where they’re falling short and improve their approach.

Key Features to Prioritize in a Trading Journal App

Finding the right trading journal app can really transform how you see your progress. It’s fantastic when an app logs every detail – entry and exit prices, fees—and lets you add your own tags for easy sorting. Of course, tracking profits and losses is key, but seeing that data come to life with charts? That’s where the real insights appear!

Ideally, a good journal will also offer risk assessment tools and space for quick notes on each trade. Automated reports are a nice touch too; they can help you learn from both your successes and those learning moments.

Automated Trade Logging & Data Capture

Wouldn’t it be great if tracking your trades was completely hands-free? With automated trade logging and data capture, that’s exactly what you get! This system effortlessly records every transaction – think timestamps, prices, quantities, everything – building a complete picture of your activity. It’s like having a dedicated trading journal app working behind the scenes, ensuring accuracy, providing clear audit trails, and simplifying reporting to help you refine your strategies.

Integration with Brokers and Exchanges

Finding the right brokers and exchanges doesn’t have to be complicated! Our platform acts like a universal adapter, making it easier than ever to connect with major providers – think Interactive Brokers, Binance, and Coinbase. We provide powerful APIs and FIX protocol support so you can tap into a wide range of asset trading options. Plus, rest assured that your connections are always secure thanks to encrypted channels and multi-factor authentication.

Customizable Fields for Detailed Notes

Want to really level up your trading journal? It’s easier than ever! You can now customize it with exactly what you need – think text boxes, dates, even dropdown menus. This lets you build a tracking system tailored to your unique strategies. Plus, these fields are adaptable, so you can keep detailed records and make smarter trading decisions.

Chart Integration & Visualization

Understanding complex financial information becomes much simpler with effective chart integration & visualization. It’s key to keep designs clear and avoid unnecessary complexity – think easy readability! Well-labeled axes and concise captions connect your visuals seamlessly to the surrounding text, ensuring clarity. Charts should always support your analysis; they’re spotlights on trading data, highlighting those crucial trends and patterns. And a thoughtfully integrated trading journal really benefits from this approach.

Performance Analytics & Reporting

Understanding how your trades are performing is key to making informed choices, right? We closely monitor important metrics – like profit/loss and win rates – giving us a clear picture of what’s working well. Visual charts and graphs make spotting trends easy, so we can proactively adjust our strategies. It’s all about getting actionable insights that drive continuous improvement.

We deliver weekly summaries alongside detailed monthly reports, highlighting both successes and areas where we could do better – which helps with targeted training. Plus, clear definitions for each metric ensure everyone’s on the same page when it comes to investment goals. Ready to take your trading performance to the next level? Explore our resources now!

Win/Loss Ratio Analysis

Understanding your win/loss ratio is key to seeing how well your sales team performs. It’s about comparing successful deals with those you didn’t close, uncovering valuable lessons along the way! Clear data visualization, like charts, really helps spot trends. Plus, looking at things like average deal size and sales cycle length gives you actionable insights for boosting performance.

Profit Factor Calculation

Understanding your Profit Factor is crucial for evaluating any trading strategy. It’s a straightforward calculation – simply divide total profits by total losses over a specific period. A score greater than one indicates you’re consistently making money, and a higher number suggests a more efficient approach! For example, earning $10,000 while risking only $2,000 yields a Profit Factor of 5—a really positive sign.

Top 5 Trading Journal Apps: In-Depth Reviews

Finding the perfect trading journal app can feel overwhelming, right? That’s why we put together this in-depth review of Top 5 Trading Journal Apps to help you make an informed decision – think of it as equipping yourself with the ideal tool for your trading journey! We’ve carefully assessed each option based on features, ease of use, and overall value. Things like automated data imports (a huge time-saver!), customizable reports, and insightful performance analysis were key considerations.

This guide offers a straightforward comparison of leading platforms, highlighting their strengths and weaknesses so you can find the best fit for your trading style. You’ll get detailed feature breakdowns, an honest look at the pros & cons, and clear explanations of pricing – from free options to premium tiers. Here’s a peek: TradeLog, TraderSync, JournalX, Chartlog, and Tickerly. Ultimately, selecting the right app is a crucial step toward consistent improvement and achieving your financial goals.

App #1: Flows Trading - The Comprehensive Solution

Ready to conquer 2025 trading? Meet Flows Trading, your new secret weapon – a trading journal app built for serious results. It’s designed to help you truly understand what’s working (and what isn’t) with detailed logging, smart analytics, and clear reports, all wrapped in an easy-to-use interface. Think about the clarity of instantly seeing patterns in your decisions! Flows Trading streamlines everything, offering automated data import, helpful risk management tools, and performance benchmarking to unlock actionable insights. Refine those strategies and boost profits – start journaling smarter today!

Overview & Core Functionality

Keeping a trading journal is key to growth, right? Our app simplifies that process, letting you easily record and analyze your trades—all in one spot! Think of it as having automatic tracking and clear data visualization at your fingertips. You’ll gain insights into performance, portfolio summaries, and even win rates, ultimately leading to smarter decisions. Curious about why journaling matters? Check out this Investopedia article: https://www.investopedia.com/trading-journal-5087314.

Pros and Cons Breakdown

Thinking through the pros and cons of any decision is always a good idea, right? A balanced breakdown thoughtfully lists both advantages and disadvantages side-by-side – it’s a really clear way to stay objective. For example, trading journal apps can be fantastic for tracking your performance, but they do take some time to maintain. Want to understand the broader value of journaling? Check out this Investopedia article: https://www.investopedia.com/terms/t/tradingjournal.asp

Pricing Structure & Plans

Flows Trading offers flexible pricing designed for every type of trader. You can start with the Basic plan, which is completely free and gives you access to core journaling and chart-analysis tools. For those who want more automation and advanced analytics, the Essential plan provides extended features at an affordable monthly rate. Power users can step up to the Pro tier, unlocking deeper performance metrics and enhanced multi-account tracking — perfect for traders who want maximum insight with minimal friction.

Best Suited For Systematics & Pro traders

Flows Trading really shines for intermediate to advanced traders who like to operate with structure and clarity. If you enjoy digging into data-driven insights, reviewing your setups across multiple timeframes, and refining your strategy with a consistent journaling routine, this platform fits naturally into your workflow. It’s especially useful for traders who manage several instruments or broker accounts and want everything streamlined in one place. Plus, if you value automation and want your analytics to update themselves, Flows Trading will feel like a major upgrade.

App #2: TraderSync - Simplicity Meets Power

Meet TraderSync, designed specifically for traders seeking a user-friendly yet powerful experience! This trading journal app really streamlines performance tracking—it’s surprisingly intuitive. Think about it: automated data imports, reports you can tailor to your needs, and helpful analytics are all right there when you need them.

TraderSync is about refining your strategies without the usual frustration. Effortless logging combined with robust analysis tools makes it a great fit for everyone from beginners to experienced investors looking to level up their trading game.

Overview & Core Functionality

Tracking your trades doesn’t have to be a chore! Our trading journal app is designed to make performance analysis simple, no matter your experience level. Quickly log each trade, review the results, and identify areas where you can refine your approach. You’ll find automated data import, customizable reports, profit/loss calculations, and even emotional journaling features—all geared toward better self-awareness and optimized strategies for effective trading journal management.

Pros and Cons Breakdown

A balanced look at any subject? That’s what you get with a pros and cons breakdown! It’s a straightforward way to see the good alongside the not-so-good, helping you make smarter decisions. This approach really values transparency – letting you consider both potential benefits and possible drawbacks. Think about it: maybe pros mean increased efficiency or savings, but cons could involve tricky setup or unexpected risks. Careful evaluation of everything is essential.

Pricing Structure & Plans

TraderSync uses a tiered pricing model built to match different trading styles and levels of experience. The Pro plan starts at $29.95/month, offering solid analytics, tagging, and trade management. Traders who want richer insights and advanced performance reports can move to the Premium plan at $49.95/month, while the Elite tier at $79.95/month unlocks full automation, AI-powered analysis, and the complete feature set. Every plan comes with import tools and core journaling features, so you can scale as your trading evolves.

Best Suited For Active Traders Focused on Self-Improvement

TraderSync tends to work best for traders who actively seek to understand their performance patterns and fine-tune their edge. If you’re comfortable labeling setups, reviewing outcomes, and making data-backed adjustments, you’ll get a lot out of it. This tool is also a great match for equity, futures, or crypto traders who want quick feedback loops, trade-by-trade analysis, and insights that help highlight both strengths and areas to improve. It’s ideal for those who like coaching-style guidance built right into the journal.

App #3: TradeLog - The Backtesting Champion

Chronos really stands out thanks to its impressive backtesting engine – think of it as a way to practice your strategies before risking real money! You can tweak tons of settings and see exactly how your ideas perform, whether they’re simple or quite complex. That level of detail gives you a significant advantage over other apps.

Chronos also does an excellent job simulating trades in various market conditions, showing you what might be profitable. Plus, visualized results and detailed reports help you refine your approach – making it a truly invaluable trading journal app for those serious about trading.

Overview & Core Functionality

Tracking your trades doesn’t have to be a chore! Our trading journal app is designed to make performance analysis simple, no matter your experience level. Quickly log each trade, review the results, and identify areas where you can refine your approach. You’ll find automated data import, customizable reports, profit/loss calculations, and even emotional journaling features—all geared toward better self-awareness and optimized strategies for effective trading journal management.

Pros and Cons Breakdown

A balanced look at any subject? That’s what you get with a pros and cons breakdown! It’s a straightforward way to see the good alongside the not-so-good, helping you make smarter decisions. This approach really values transparency – letting you consider both potential benefits and possible drawbacks. Think about it: maybe pros mean increased efficiency or savings, but cons could involve tricky setup or unexpected risks. Careful evaluation of everything is essential.

Pricing Structure & Plans

TradeLog uses annual pricing tailored to the number of trades you process each year. The Investor plan, at $219/year, covers up to 1,500 trades and includes complete wash-sale and tax-reporting tools. Active traders can upgrade to the Trader tier at $359/year for up to 5,000 trades, while professionals who execute large volumes can opt for the Elite plan at $459/year. Each tier includes full tax-compliant reporting, making it a strong choice for traders who prioritize accuracy and year-end simplicity.

Best Suited For Swing & Backtesters

TradeLog is a strong choice for traders who deal with large volumes of trades and need highly accurate tracking for tax-reporting purposes. If you trade frequently—across stocks, options, or futures—and want a journal that keeps everything compliant, clean, and export-ready, this platform is a great fit. It’s especially suited for U.S. traders who need to manage wash-sales or detailed capital-gains calculations. If precision and reporting clarity matter as much as performance analysis, TradeLog is the right tool.

App #4: JournalX - Mobile-First Journaling

Ever wish you could jot down trade ideas or reflections quickly, wherever you are? App #4, JournalX, is a trading journal app designed just for that! It’s a mobile-first application built for traders and investors, offering a really user-friendly experience on both smartphones and tablets. Think of effortlessly capturing your insights anytime—that’s the beauty of it. Key features like customizable templates and automated performance tracking help build better trading habits. What makes JournalX stand out? It integrates sentiment analysis and visual charting right into your journal entries, giving you a powerful way to analyze decisions and boost profitability.

Overview & Core Functionality

Tracking your trades doesn’t have to be a chore! Our trading journal app is designed to make performance analysis simple, no matter your experience level. Quickly log each trade, review the results, and identify areas where you can refine your approach. You’ll find automated data import, customizable reports, profit/loss calculations, and even emotional journaling features—all geared toward better self-awareness and optimized strategies for effective trading journal management.

Pros and Cons Breakdown

A balanced look at any subject? That’s what you get with a pros and cons breakdown! It’s a straightforward way to see the good alongside the not-so-good, helping you make smarter decisions. This approach really values transparency – letting you consider both potential benefits and possible drawbacks. Think about it: maybe pros mean increased efficiency or savings, but cons could involve tricky setup or unexpected risks. Careful evaluation of everything is essential.

Pricing Structure & Plans

JournalX keeps things simple with straightforward monthly pricing. The Pro plan starts at $5/month and includes the essential journaling tools most traders need. For those who want deeper analytics, enhanced tagging, and more customization, the Elite plan at $8/month offers added power without complexity. Both tiers are easy to use, affordable, and ideal for traders who want clean, distraction-free journaling without committing to expensive software.

Best Suited For Mobile Traders

JournalX works well for traders who prefer a simple, distraction-free environment to review their trades and strengthen their habits. If you value a clean interface, clear journaling routines, and a focus on your mindset and process rather than complex analytics, you’ll feel at home here. It’s especially suited for new traders or long-term swing traders who want a straightforward way to document decisions, track progress, and stay consistent without being overwhelmed by too many features.

App #5: TradeWise - Budget-Friendly Option

Tracking your trades doesn’t have to be complicated! If you’re searching for an easy, budget-friendly way to do it, check out App #5, TradeWise. It really simplifies things—you can log each trade, see how you’re performing, and even identify patterns without feeling overwhelmed. Whether you’re just starting out or looking for a cost-effective solution, TradeWise is fantastic; they offer a great free tier with optional upgrades beginning at only $4.99 per month! Why not download TradeWise now and start making smarter decisions?

Overview & Core Functionality

Tracking your trades doesn’t have to be a chore! Our trading journal app is designed to make performance analysis simple, no matter your experience level. Quickly log each trade, review the results, and identify areas where you can refine your approach. You’ll find automated data import, customizable reports, profit/loss calculations, and even emotional journaling features—all geared toward better self-awareness and optimized strategies for effective trading journal management.

Pros and Cons Breakdown

A balanced look at any subject? That’s what you get with a pros and cons breakdown! It’s a straightforward way to see the good alongside the not-so-good, helping you make smarter decisions. This approach really values transparency – letting you consider both potential benefits and possible drawbacks. Think about it: maybe pros mean increased efficiency or savings, but cons could involve tricky setup or unexpected risks. Careful evaluation of everything is essential.

Pricing Structure & Plans

TradeWise stands out with its fully free plan, giving traders complete access to its journaling features without any subscription fees. You can log trades, review performance, and follow guided improvement tools at no cost. This makes it an excellent option for beginners or casual traders who want to build discipline and track progress without worrying about monthly bills. With everything included in the free tier, getting started is as simple — and accessible — as possible.

Best Suited For budget-conscients traders

TradeWise is ideal for traders who want a journal that also provides coaching-style insights and structured learning. If you appreciate tools that highlight improvement opportunities, suggest better habits, and help you understand why certain trades worked or didn’t, this platform is a great fit. It’s a solid option for beginner to intermediate traders who want both education and analysis in one place, especially those looking to build a disciplined strategy with guided support.

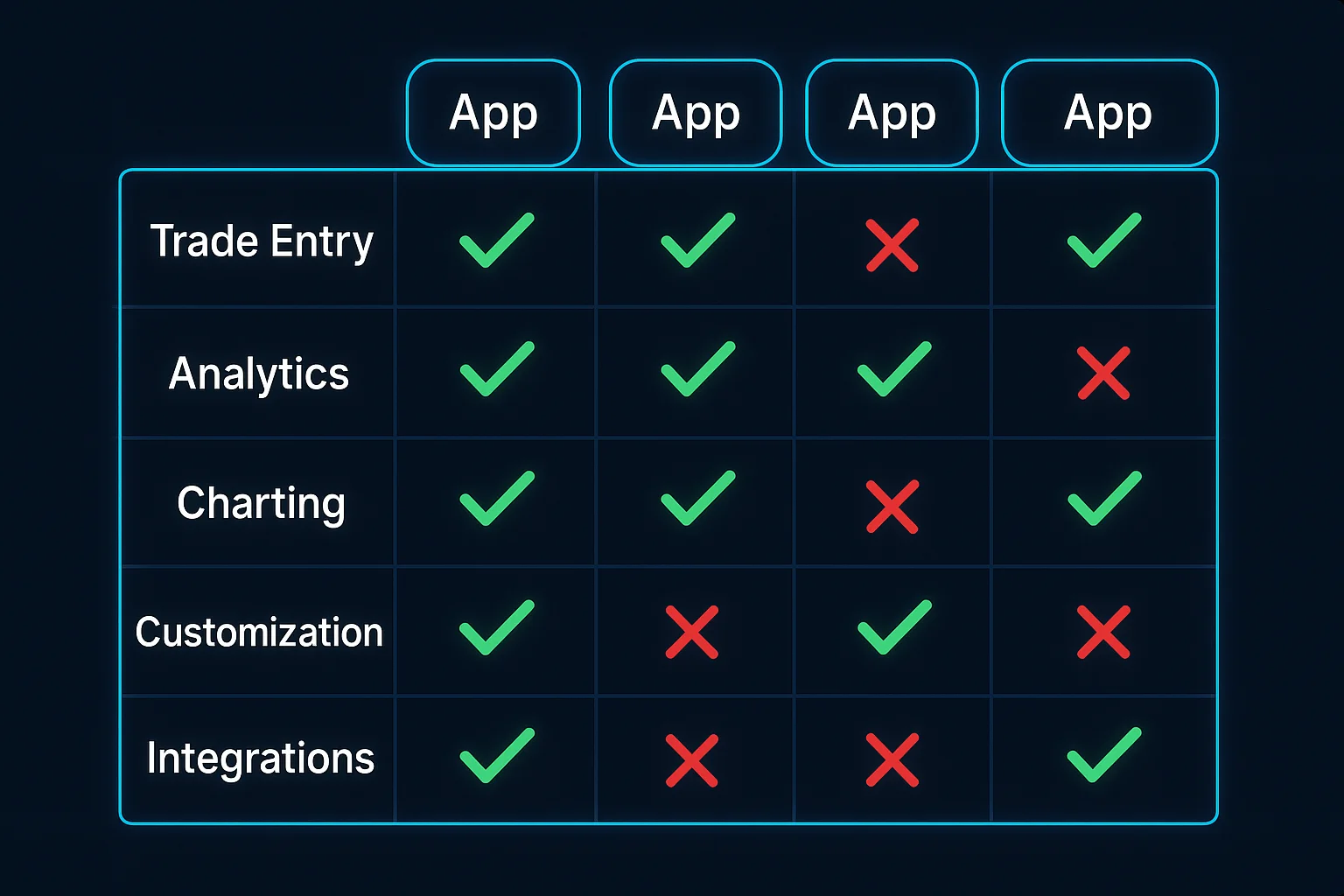

Comparative Analysis of Trading Journal Apps

Choosing the best trading journal apps can feel overwhelming, but comparing options reveals some clear differences. Some excel at data visualization – offering everything from detailed charts to quick summaries – while automation capabilities also vary quite a bit. You’ll find that certain apps connect directly with your broker for effortless trade logging, whereas others require manual entry. Naturally, data security is paramount; always check the encryption methods used by each app. Plus, a user-friendly interface can significantly speed up performance tracking and analysis.

Several popular choices include JournalX (known for its detailed reports), TradeFlow (boasting strong automation), and ProfitPilot (excellent data visualization). Of course, no app is flawless – JournalX has higher pricing, TradeFlow’s setup can be a little complex, and ProfitPilot could benefit from more advanced backtesting. Ultimately, the ideal app depends on your individual trading style and specific needs.

Feature Comparison Table

Comparing products can feel overwhelming, right? A feature comparison table is like having a cheat sheet – it neatly organizes attributes so you can quickly see how different options measure up! Traders and investors find these visual tools incredibly helpful for rapidly assessing key features. Keeping things focused on the essentials prevents information overload, and clear formatting with concise language makes all the difference. For example, when searching for trading journal apps, a table instantly shows pricing and which assets are supported – super handy!

Automated Logging

Automated logging quietly tracks all the important details of your trades—things like placing orders, how they execute, and even account balance changes. This consistent record creates a full history, which is super helpful for analyzing performance and staying compliant with regulations. You’ll see benefits like more accurate data and easier reporting; detailed logs can reveal patterns and let you evaluate strategies to improve your trading results. A good trading journal app really makes the most of this!

Chart Integration

Strategic chart integration really elevates how we grasp information within reports, doesn’t it? Picking the right visuals—perhaps bar graphs for speedy comparisons or line charts to showcase trends—makes all the difference. Just remember clear axis labels and clean designs; avoiding clutter keeps things polished and professional.

Customization Options

Want a trading journal that truly works for you? Our platform offers extensive customization options, so you can tailor it to your exact needs. Think about adding custom tags—labels for specific strategies, perhaps—to unlock deeper insights into your activity. Plus, set automated alerts based on performance! You’ll find key features like flexible profit/loss visualizations and easy data export.

Backtesting Capabilities

We really focus on validating your trading strategy—it’s key! Our platform uses thorough backtesting, including techniques like walk-forward analysis and Monte Carlo simulations. Think of it as putting your plan through its paces against different market conditions to ensure resilience. Plus, rigorous backtesting with sensitivity analysis helps minimize risks, giving you confidence.

Mobile Accessibility

Creating truly inclusive designs absolutely must include mobile accessibility – it’s about making sure everyone can easily use your site, no matter their abilities. Prioritize responsive design to ensure content looks great on any device. And don’t forget regular testing with screen readers; that helps you catch potential issues and guarantees a smooth experience for all visitors.

Reporting Features

Want to really understand how your trading journal is performing? Our platform makes it simple! Check out the clear dashboards in the ‘Analytics’ tab – they show you key metrics like profit/loss and win rate at a glance. You can easily customize date ranges, too. Plus, get detailed breakdowns by asset class or trading style, and download your reports as CSV or PDF for further review.

Pricing Tiers Compared

Finding the right fit for your trading style shouldn’t break the bank – that’s why we crafted our pricing tiers carefully. The Basic plan offers solid journaling tools to get you started, and stepping up to Pro unlocks some seriously powerful analytics and custom reports. Need even more? Our Premium tier provides extra support plus early access to exciting new features! Your trading journal app can evolve alongside your skills – each level builds on the last. Ready to take a closer look? Check out our full pricing page and let’s optimize your trading performance together!

Selecting the Right App for Your Needs

Finding the perfect app can really make a difference, helping you work smarter and achieve more! But where do you even begin? Start by clearly defining what you need – what problems are you trying to solve? It’s easy to get dazzled by fancy designs, but remember, an app overflowing with features isn’t helpful if it doesn’t address your core needs. Consider how intuitive it is to use, whether it plays nicely with the other tools you rely on, and of course, its security.

When weighing up different options, be realistic about both their strengths and weaknesses. For example, trading journal apps really need robust data tracking and analysis capabilities. Don’t just take marketing claims at face value; see what actual users are saying and definitely try out free trials to get a feel for how it performs in real life. Ultimately, the best app is one that integrates seamlessly into your day-to-day workflow and consistently delivers genuine value.

Beginner Traders: Prioritizing Ease of Use

Starting out in trading? It’s smart to choose a platform that feels easy to use – really important when you’re just beginning! A clean interface can make all the difference, helping you feel confident instead of overwhelmed. User-friendly features, like simple charts and clear order entry, are key for early wins. Forget complicated jargon; focus on platforms that explain things clearly so you grasp how the market operates.

Consider tools that are straightforward to navigate – a trading journal app, for instance, should make tracking your progress effortless. Ultimately, accessibility empowers beginners like yourself to learn and refine your strategies.

Intermediate Traders: Balancing Features and Cost

Intermediate traders often face a balancing act: getting the most out of advanced tools while keeping expenses manageable. While platforms like TradingView and ThinkorSwim offer impressive charting capabilities, those subscriptions can really add up! It’s smart to prioritize feature relevance – don’t pay for things you won’t actually use. Perhaps Webull or tastytrade could be a better fit, providing a solid mix of features at competitive prices. Clearly articulate cost structures and understand all the details like commissions and data feeds. Ultimately, evaluating your trading volume and strategy will help you find the most cost-effective solution.

Advanced Traders: Seeking Robust Analytics & Backtesting

Experienced traders know that having the right tools can make all the difference, and our platform delivers just that. Imagine having a personal research assistant – that’s what our robust analytics, including customizable charts and real-time market data, offer you. Plus, with backtesting, you can rigorously test your strategies using historical data to optimize performance and minimize risk.

Our highly configurable backtesting engine provides incredible flexibility, letting you simulate various scenarios and fine-tune parameters confidently. Ready to unlock data-driven insights and boost your ROI? Explore the platform today!

Conclusion: Elevate Your Trading with Consistent Journaling

It’s amazing how much we can learn from simply tracking our progress – especially when it comes to trading! Keeping a trading journal is truly invaluable for continuous improvement and seeing better outcomes. Imagine it as your own personal log, where you jot down the details of each trade: entry and exit points, the reasoning behind those choices, and even how you were feeling at the moment. This level of detail really helps traders become more aware of themselves, allowing them to identify patterns – both positive and negative – that they might otherwise miss.

Regular review is key; it shines a light on biases and inefficiencies that can easily slip under the radar while you’re actively trading. So, don’t delay—start your journal today! Even brief daily entries can make a real difference. Whether you prefer a dedicated trading journal app or a straightforward spreadsheet, consistency is what matters most. Building this habit will unlock deeper insights into your trading psychology and ultimately boost your long-term success.

Recap of Key Considerations

Want to level up your trading game? A trading journal app is a fantastic tool! It’s not just about noting whether you won or lost; really digging into why you made those trades – entry/exit points, emotions, everything – can be incredibly insightful. Taking the time to review this information regularly helps reveal patterns and biases that might be impacting your decisions.

Think of it like this:

- Consistent journaling builds self-awareness.

- You’ll start to pinpoint profitable strategies and areas where you could improve.

- And regular reviews lead to smarter adjustments overall.

Importance of Data Tracking

To really succeed in trading and investing, consistent data tracking is essential. Looking back at past performance can reveal helpful patterns and areas where you could improve – allowing for smart adjustments to your strategy. This approach helps clarify how the market works and ultimately boosts your return on investment. Luckily, trading journal apps make this easier than ever, offering valuable insights into your decisions so you can optimize results and minimize risk.

Benefits of Pattern Identification

Recognizing patterns can really give traders and investors an edge! Spotting these recurring trends unlocks predictive analysis, which helps you make smarter choices and potentially see better returns. It’s about minimizing risk and fine-tuning your strategies as you go—a data-driven approach that leads to more profitable outcomes, especially when diligently tracking everything in trading journal apps.

Flows.Trading: A Powerful Solution for Modern Traders

Want to level up your trading game? Flows.Trading is designed to help modern traders do just that! It’s a really streamlined platform focused on trade journaling and analysis, giving you valuable insights—no matter if you’re day trading or investing for the long haul. You can easily spot what’s working well and where you could improve. Plus, it offers automated data capture, customizable reports, and clear visualizations. Start tracking your trades effectively today and check out Flows.Trading!

Ready to take action?

Ready to streamline your trading journal? Check out flows.trading for a platform with integrated automated journaling.