Start a Trading Journal: Beginner’s Guide & Best Practices

Table of Contents

Why Keep a Trading Journal?

Thinking about leveling up your trading game? A trading journal can be surprisingly powerful! It’s more than just jotting down wins and losses; it’s really about understanding yourself as a trader. Picture this: a detailed log of each trade – when you got in, when you got out, why you made those choices, even how you were feeling at the time. That kind of record unlocks some amazing insights.

Regular journaling actually builds emotional discipline, helping you steer clear of impulsive decisions driven by fear or excitement. It gives you an objective look at your performance, free from any personal biases. You can use it to uncover weaknesses in your strategy, identify those triggers that lead to less-than-ideal choices, and celebrate the wins while learning from setbacks. Seriously, starting a trading journal is an investment – why not give it a try today?

The Foundation of Consistent Profitability

Building consistent profitability really comes down to repeatable processes – think of it as establishing reliable routines that consistently deliver results. It’s about focusing on long-term strategies, resisting the temptation of fleeting gains. A disciplined approach to managing risk, combined with a good understanding of what’s happening in the market, is crucial for sustainable success and ultimately creates more predictability in your trading.

How Journaling Impacts Long-Term Success

Want to see real long-term success? Consistent journaling might be the key! Studies reveal that regular reflection helps build clarity and a better understanding of yourself – super important for setting goals. Think about it: tracking your progress, tackling challenges, and learning from experiences builds resilience; it’s like getting back up after a stumble, stronger than before. A trading journal especially shines here, revealing patterns and biases to improve decisions and keep you motivated.

Identifying and Overcoming Biases

It’s really important to spot and tackle biases when making trading decisions – it can significantly improve your results! Think about confirmation bias, where we tend to only notice things that already align with our beliefs, or the availability heuristic, which makes us lean on information that’s easily remembered. Simply being aware of these tendencies is a great first step.

To minimize their effect, consider keeping a trading journal to document your reasoning before each trade; it’s surprisingly helpful! Plus, actively look for alternative perspectives and regularly review past trades with an open mind – this proactive approach can lead to more rational and profitable outcomes.

Tracking Performance & Measuring Progress

Seeing how a trading strategy performs is really important – it’s how we know if things are clicking! Keeping an eye on key numbers like ROI and conversion rates gives us a good sense of what’s working well. Charts and graphs can be super helpful too, making those trends pop so you can make smarter choices. Plus, regularly checking your trading journal highlights both where you shine and areas to tweak. Let the data lead the way as you refine your approach – consistent monitoring really keeps you on track toward reaching your financial goals.

Learning from Mistakes (and Celebrating Wins!)

Reflecting on both successful trades and those that didn’t go as planned is vital for any trader’s growth. A trading journal provides an excellent tool to dissect your performance – maybe you underestimated risk, or perhaps acted too quickly? Equally important, understanding why a winning trade worked offers valuable lessons. Documenting the details of both outcomes reveals patterns and areas where adjustments can be made. This continuous refinement process steadily sharpens your skills and improves profitability. Why not start keeping a trading journal today – it’s a simple step toward reaching your full trading potential!

What Information Should You Record?

Want to really level up your trading game? Then seriously consider keeping a detailed trading journal. It’s more than just jotting down numbers; consistently recording specifics like entry and exit prices, trade size, currency pair, and leverage provides invaluable data. But go deeper – why did you make those choices? What technical indicators or news influenced you? Don’t forget to note how you felt during the trade either; recognizing your emotions is a big part of improving.

Organize everything logically, separating profit/loss from details like execution time and market context. Short, clear notes are best! Ultimately, it’s about extracting actionable insights – what can you learn? A well-maintained trading journal really does act as your roadmap to consistent success.

Essential Data Points for Every Trade

Becoming a more effective trader really hinges on keeping an eye on key data points – it’s similar to monitoring your health with regular checkups! Essential data you should track includes entry and exit prices, how long trades last, position size, and that all-important risk-reward ratio. Accurate record-keeping lets you objectively analyze your performance and spot patterns.

Beyond that, consider metrics like win rate, average profit per trade, and maximum drawdown. A trading journal is invaluable for logging these details; it offers insights into what’s working and where to improve – ultimately leading to better decisions and increased profitability.

Entry Details: Price, Time, Asset, Size

Keeping a detailed trading journal is key for growth! To ensure accurate analysis, each entry should include specifics. You’ll want to note the Price – that’s the execution cost – alongside Time, marking exactly when you made the trade. The Asset, like AAPL or TSLA, tells you what you were trading, and Size shows how many shares or contracts were involved. For example, Price $150.25, Time 10:30 AM, Asset TSLA, Size 100 shares – consistent recording with these values really helps review your performance.

Exit Details: Price, Time, Outcome

We’re absolutely delighted to share some incredible news – StellarTechs acquired us in a successful exit valued at $12.5 million! That’s a remarkable 30% above our initial valuation, finalized on October 26th after all approvals came through. This validates years of dedication and delivers substantial value for everyone involved. Now, StellarTechs can leverage our innovative technology, and our shareholders received distributions quickly – a truly positive financial outcome.

Qualitative Insights - Beyond the Numbers

Qualitative insights truly enrich market research, moving past just the numbers. Think about it – analyzing interviews and those thoughtful open-ended survey responses unlocks a deeper understanding of user behaviors, motivations, and even their feelings. Quantitative methods sometimes miss these nuances! Direct quotes really bring discoveries to life, showing us why people do what they do. Spotting patterns within this data connects everything back to our initial questions, giving us a richer view of customer needs. To learn more about user research techniques, check out https://www.interaction-design.org/literature/topics/user-research. Why not start exploring qualitative data and elevate your trading journal today?

Reasons Behind Your Trades

I like to combine technical and fundamental analysis when making trading decisions. For example, my recent entry into XYZ stock was based on a breakout past resistance, which aligned nicely with some positive earnings reports. Keeping a detailed trading journal helps me spot patterns and refine my approach—it’s really key for growth! You can learn more about journaling best practices here.

Emotional State During Trading

Ever notice how your mood impacts your trading? It’s true! Emotions like fear and greed can trigger impulsive decisions, potentially costing you opportunities. Being aware of these influences—like chasing losses or feeling overly confident after a win—is really important for long-term success. Simple things help; try mindful breathing, use stop-loss orders, and stick to your strategy. Plus, regularly reviewing your trading journal can reveal those emotional patterns.

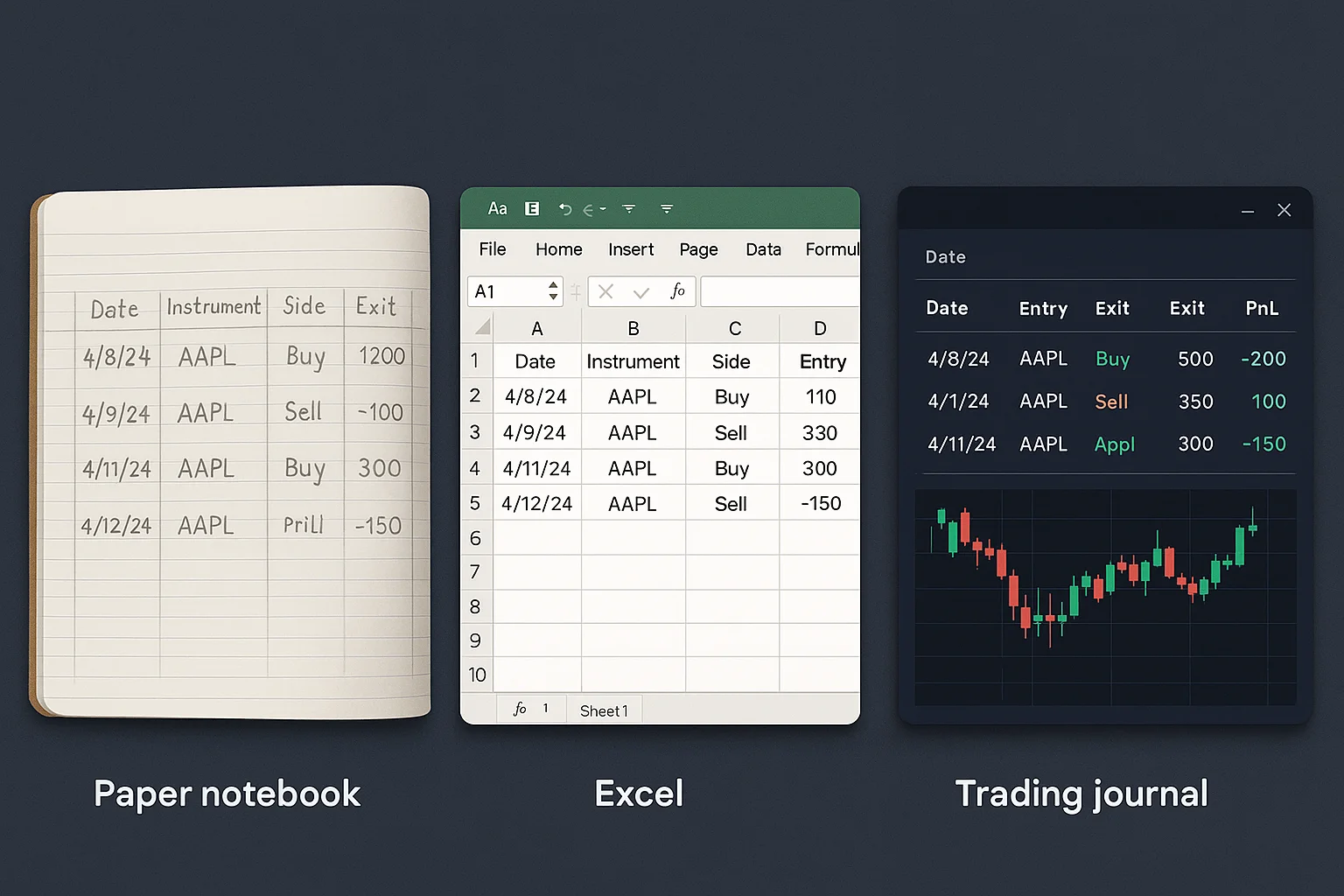

Choosing a Journaling Method

So, you’re looking to level up your trading game? Finding the right trading journal method is a fantastic step! There are so many options available; it’s really worth exploring what clicks with your style. A bullet journal, for instance, offers incredible flexibility – perfect for tracking trades and those quick notes that pop into your head. Or perhaps you’d like to focus on the mental side? A gratitude log can be surprisingly helpful in highlighting the positives within your trading psychology.

Structured templates are great if you love detailed analysis, but sometimes just letting it all out with freeform writing is exactly what you need. Don’t stress about getting it perfect right away! Maybe start simple – a spreadsheet works well – and then evolve to something more complex later on. The key? Consistency. A trading journal you actually use will give you invaluable insights into your habits, helping you identify areas for improvement and ultimately leading to better trading results.

Paper Journals: The Traditional Approach

There’s something truly special about jotting down your thoughts in a paper journal – it’s wonderfully satisfying! The feeling of pen on paper often sparks deeper reflection than typing, almost like disconnecting to reconnect with yourself. This focused space is particularly valuable for a trading journal, providing dedicated analysis time. You’ll find so many styles available, from lined pages perfect for structure to blank ones offering complete creative freedom, plus a variety of binding options. Consider what feels right – the goal is to create a journaling system that supports consistent tracking and helps you grow.

Pros and Cons of Physical Notebooks

Physical notebooks offer some real advantages – things like better handwriting, improved memory recall, and a break from staring at screens! Interestingly, note-taking by hand can even spark creativity. Of course, they aren’t perfect; finding what you need later can be tricky, and they’re prone to getting lost or damaged. Digital options really excel with instant organization and cloud backups, but digital journals do rely on devices and battery life. So, it truly comes down to what works best for you!

Spreadsheets (Excel/Google Sheets): Customizable & Accessible

For beginner traders, spreadsheet software like Excel and Google Sheets offers a surprising amount of flexibility! It’s easy to set up a system to track your trades – entry price, exit price, profit or loss – all in a format you can tailor to your needs. This makes analyzing performance and finding patterns much faster. And the best part? They’re incredibly accessible, working seamlessly on pretty much any device. Seriously, keeping a trading journal with spreadsheets is a really smart move for improving profitability.

Setting Up Basic Spreadsheet Columns

Organizing trading data becomes much easier when you create basic spreadsheet columns – it’s really the key! Start by giving them clear labels like ‘Date,’ ‘Ticker,’ or Entry Price; think of those as helpful identifiers. A logical order, whether showing trades chronologically or grouped by what you’re trading, makes finding information a breeze. These columns often hold numbers, text, and dates, forming a solid trading journal that beginners can use to track and analyze their performance.

Dedicated Trading Journal Software: Streamlined Efficiency

Ever feel like you’re losing precious time wrestling with trade notes? Dedicated trading journal software can truly make a difference, freeing up hours previously spent on tedious tasks! It’s amazing how streamlined record-keeping can be. Features like automated logging and instant performance analysis help you quickly identify what’s working—and what isn’t.

Powerful analytics uncover hidden patterns, while customizable reports give you clear insights into your profitability. Stop second-guessing your trades; start understanding them! Build a robust trading journal now to unlock consistent growth and take your trading to the next level.

Benefits of Automated Tracking & Analysis

Automated tracking and analysis truly empowers beginner traders! It eliminates the hassle of manual data entry – imagine all that time you’ll save instead of battling spreadsheets. Getting real-time insights into your trades quickly shows what’s working and where to adjust, a vital step toward growth. You’ll likely see fewer errors, make better decisions, and potentially lower costs with optimized strategies. Plus, an automated trading journal makes consistent learning easier, which can really boost profitability.

Setting Up Your Trading Journal (Practical Steps)

Becoming a more consistent trader often hinges on one key habit: keeping a trading journal. It’s surprisingly simple to get started – a basic spreadsheet like Google Sheets or Excel works great, or you could check out dedicated software like Traders Copilot. To begin, just track the essentials: the date of your trade, what asset you were trading (maybe AAPL), your entry and exit prices, how much you traded, and whether it was profitable or not. Don’t stress about making it overly complicated at first!

But here’s where things get really interesting. Alongside those numbers, add some notes – your thoughts. Why did you enter that trade? What tipped you off? And just as importantly, how were you feeling? Were emotions like fear or excitement influencing your decisions? Logging every single trade, no matter the size, creates a valuable record to analyze and refine your approach over time.

Structuring a Spreadsheet for Effective Journaling

For beginner traders, a well-structured trading journal spreadsheet can be a real game-changer! It’s about creating a layout that makes sense to you, simplifying how you analyze your trading data and learn from what’s happened. Don’t forget date and time columns – accuracy is important. Think about adding categories like trade strategy, the asset itself, and of course, the outcome; this focused approach really helps with review and improvement.

Example Spreadsheet Layout with Key Columns

For those just starting out in trading, a well-organized trading journal spreadsheet can be surprisingly useful – almost like having your own personal coach! Key details to track include things like the date, what asset you were trading (using stock tickers is handy), your entry price, and where you exited. Most importantly, jot down why you made each trade; that kind of self-reflection really helps. Finally, noting whether it was a profit or loss lets you see how you’re performing over time.

Using flows.trading: A User-Friendly Solution

Managing trades doesn’t have to be overwhelming, especially when you’re just getting started. That’s why flows.trading offers such an intuitive way to keep track of everything and see how you’re really doing. It takes complicated trading data and turns it into easy-to-understand insights – no need for advanced skills!

Here’s what makes it great:

- Simple Logging: Jot down your trades quickly.

- Clear Visualizations: Get a snapshot of your performance instantly.

Ready to level up your trading? Start a trading journal with flows.trading today and see the difference! Visit our website to get started.

Quick Tour of flows.trading Features and Setup

Want to level up your trading game? flows.trading offers a really intuitive trade journaling platform—it’s surprisingly easy to get started! Just link your brokerage accounts, customize the journal fields exactly how you like them, and let flows.trading handle the rest. You’ll gain automated trade capture, insightful performance analysis, and clear visuals to track your progress and ultimately improve your trading.

Analyzing Your Journal Entries

Really wanting to level up your trading? Then taking a close look at your trading journal is absolutely essential. It’s about more than just recording what happened; it’s about finding those repeating patterns – are you consistently winning with certain setups, or are they leading to losses? Don’t forget to consider how emotions played a role in your decisions too! Recognizing those triggers can really help prevent impulsive moves.

A solid trading journal provides some seriously valuable data for honest self-reflection. After each trade, ask yourself: what could you have done differently? Were your risk management strategies on point? This kind of analysis is how you refine your strategy and build a more disciplined approach. Here’s a quick recap:

- Look for recurring themes.

- Note emotional shifts & triggers.

- Focus on actionable takeaways.

Reviewing Trade History Regularly

It’s really valuable to regularly look back at your trading history – it’s a key part of getting better! Seeing those patterns, both the successes and what didn’t quite work out, can help you tweak your strategies. This kind of proactive review gives you a much clearer picture of how markets move and how you perform, leading to smarter choices.

Your trading journal is packed with actionable insights; think about things like when you entered or exited trades, risk-reward ratios, and even those emotional factors that sometimes creep in. Consistent review really helps manage risk and optimize your future trading for better results.

Frequency & Best Practices for Analysis

Finding the right data analysis frequency really depends on how you trade! Active folks often see value in daily reviews, while those with longer-term strategies might prefer weekly or even monthly assessments. A trading journal is a fantastic tool for spotting patterns and refining your approach – it’s something I highly recommend.

Scheduling review time and documenting both wins and losses are key best practices. This consistent routine helps foster continuous improvement, leading to more informed decisions—absolutely essential for any beginner.

Identifying Patterns in Trading Behavior

It’s really key to notice patterns in your own trading – that’s a big part of consistent success! Recognizing tendencies, like maybe chasing losses or getting carried away with wins, helps you manage those emotions and make smarter choices. Instead of trying to guess why people trade, focusing on what they actually do gives you a much clearer picture. You’ll likely see things like confirmation bias or FOMO pop up. Understanding these biases is super helpful for beginners looking to build more disciplined strategies and keep better trading journals.

Common Pitfalls to Look For

Getting a trading journal up and running? It can feel overwhelming at first! Many traders miss crucial details – things like entry and exit prices, or even how they felt during the trade. Inconsistent journaling leads to fragmented data, so try scheduling regular entries for better accuracy. Ultimately, reviewing your past trades is key; it helps you spot patterns and fine-tune your approach.

Drawing Actionable Conclusions from Your Data

Understanding data and turning it into actionable steps is key for making informed decisions. Rather than just presenting findings, consider the ‘so what?’ – really explaining what those results mean. Specificity makes a big difference; let’s aim for measurable outcomes instead of general ideas. Focus on your most impactful takeaways to keep things easy to understand.

To truly add value, translate your analysis into clear recommendations. For example, noting a 15% increase in sales during Q3 – thanks to campaign X – is far more helpful than simply saying ‘sales rose.’ Ready to put these insights to work? Start today!

Advanced Journaling Techniques

It’s easy to think of journaling as just jotting down daily events, but advanced techniques offer some truly powerful tools – especially when it comes to improving your trading! A trading journal shouldn’t be a simple record of what you did; instead, picture it as a living document reflecting your thought process. For example, freewriting—just writing continuously without stopping to edit—can surprisingly help uncover those subconscious biases that might be quietly affecting your choices. You might even find dream analysis offers insights into anxieties or motivations influencing how much risk you’re comfortable taking.

To make the most of it, try incorporating things like bullet point lists outlining potential trade setups and numbered breakdowns after each trade (entry rationale, exit strategy, outcome). Don’t forget to briefly summarize market news too. Regularly reviewing your trading journal is key; it lets you spot patterns, refine your approach, and build a more disciplined mindset—and that’s what leads to long-term success.

Tagging Trades by Strategy

Ever wonder how to really understand what’s working in your trading? Implementing tagging trades by strategy can be a game-changer! It’s like giving each trade a label, allowing you to easily see which approaches are consistently successful and where you might need to adjust. The key is using clear, specific terminology – ditch the vague classifications; those often hide valuable insights that could boost your performance.

Categorizing Trades for Performance Evaluation

Understanding what’s working in trading really comes down to smart categorization! Defining distinct categories – like momentum, value, or arbitrage – allows us to consistently analyze our strategies. This approach reveals valuable insights and helps guide adjustments toward better profitability. Consistent tracking is key; be sure to justify your choices based on your goals. A trading journal, organized using these categories, can be a seriously powerful tool for growth.

Risk Level and Market Conditions

Market behavior and risk assessment go hand-in-hand, don’t they? When volatility spikes – as it often does – leveraged investments can really take a hit. Consider this: even a 10% jump in implied volatility could trigger stop-loss orders significantly more frequently, perhaps by around 5%. External forces like interest rate changes or global news also play a role, constantly reshaping market conditions. Keeping an objective perspective is crucial for making informed decisions. Want to boost your trading success? Start tracking your trades with a trading journal – it’s a great first step!

Refining Strategies Based on Context

Achieving consistent success really comes down to tweaking your approach as things change. Think of it like navigating a ship – you need to adjust course based on the currents! For those just starting out, keeping a trading journal is incredibly valuable; it helps spot patterns and areas where you can grow. Maybe that means adjusting your risk or trying something new—your trading journal will guide you toward effective dynamic adjustments.

Ready to take action?

Ready to start your own trading journal? Visit flows.trading for powerful tools and resources.