Forex Trading Journal: Track Your FX Trades for Profit

Table of Contents

Why Keep a Forex Trading Journal?

Seriously considering a forex trading journal? It can be an absolute game-changer if you’re striving for consistent profits! It’s about so much more than just jotting down wins and losses; picture it as a structured way to really understand your decisions. Think about recording the specifics – entry and exit points, why you made that trade, how you managed risk, and even what you were feeling at the time. This creates a fantastic dataset for honest self-reflection and growth.

It’s amazing how this detailed record can reveal patterns—both those leading to success and those holding you back. Tracking key metrics like your win rate and average profit/loss gives you objective feedback, too. Recognizing biases and impulsive actions is crucial for disciplined trading, and regularly reviewing your journal encourages continuous learning. Ultimately, a well-kept forex trading journal empowers you to fine-tune your strategies, avoid costly mistakes, and dramatically boost your long-term success in the forex market.

Benefits of Forex Journaling

For any trader, keeping a Forex trading journal is seriously helpful! It’s amazing how regularly jotting down your trades can reveal patterns – the good and the bad. This detailed record allows for objective analysis; you can really step back and understand why certain strategies work or don’t. It’s like having a personal coach to improve your trading game!

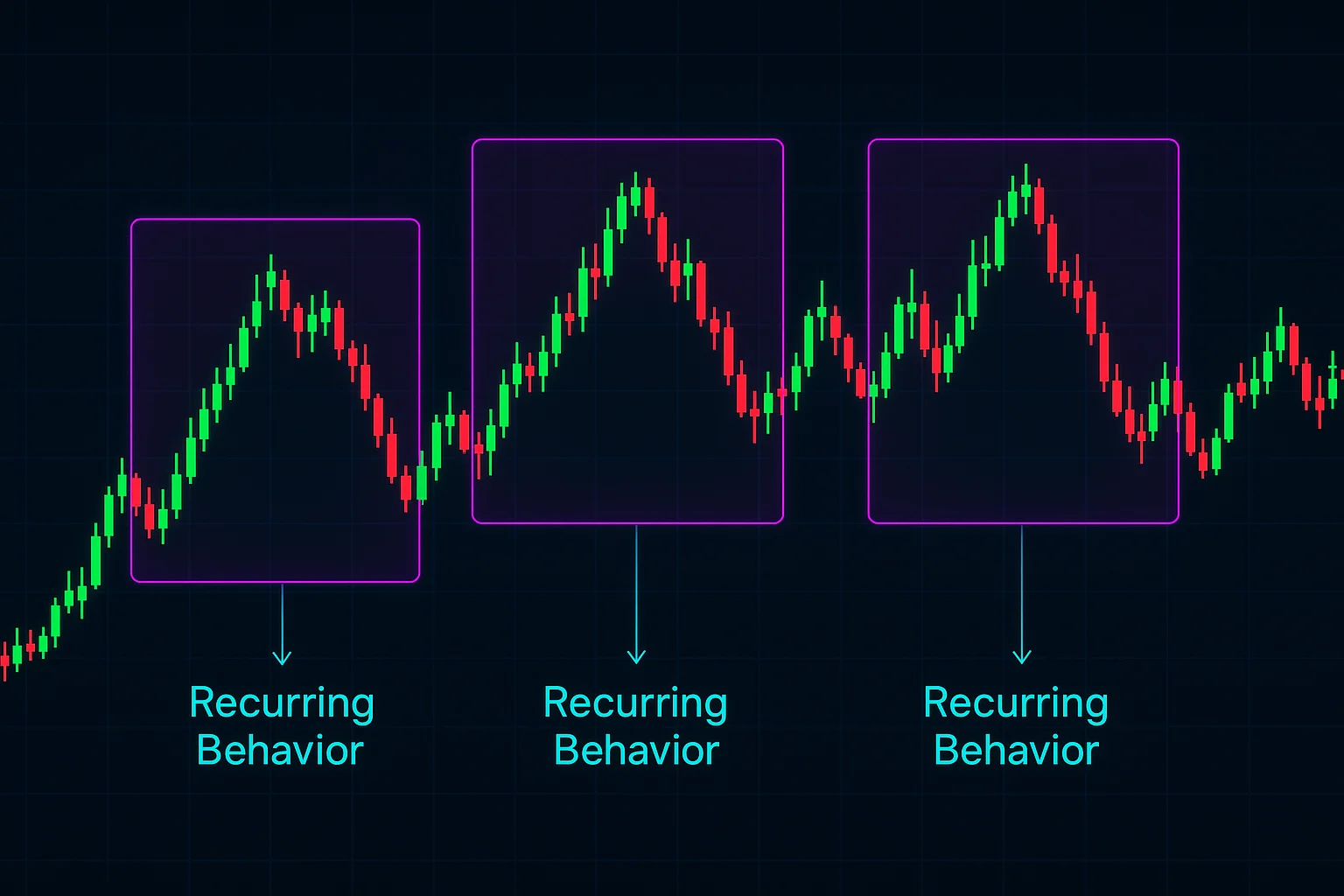

Identifying Recurring Patterns & Biases

Really want to level up your forex trading? Taking a close look at your forex trading journal is essential! It’s about more than just wins and losses; identifying those recurring patterns and biases reveals where you can truly improve. Think about behavioral tendencies – are you chasing losses, or maybe straying from your plan? Distinguishing predictable errors from random market noise helps a lot, too. Becoming aware of things like confirmation bias will boost your self-awareness and ultimately enhance your trading.

Improving Trading Strategy and Consistency

Becoming a more consistent trader requires effort! A great first step is keeping a detailed trading journal – jot down exactly when you entered and exited trades, why you made those decisions, and what the outcome was. Tools like a Forex trading journal (you can find helpful ones at https://flows.trading/trade-analysis/) really help reveal patterns. Regularly review your performance honestly, tweaking your strategy based on what you learn – practical adjustments are key!

Managing Emotions and Maintaining Discipline

Achieving consistent success in Forex trading often comes down to managing emotions—it’s a big deal! Keeping a Forex trading journal can really help you identify those triggers that lead to impulsive decisions. A helpful tip? Set clear risk limits and stick to your plan, even when the market throws curveballs. Emotional discipline is key; it genuinely boosts profitability.

Accountability and Self-Awareness

Consistent improvement in Forex trading really hinges on accountability and self-awareness, doesn’t it? Taking the time to regularly review your Forex trading journal can be incredibly insightful. You’ll start noticing patterns – both successes and areas where you could do better. This kind of introspection helps reveal how emotions influence your decisions, ultimately leading to a stronger understanding of yourself as a trader.

Briefly Mention Flows.trading as a Solution

It’s common for forex traders to struggle with truly understanding their trading results – where did things go right, and what could be better? Without keeping a consistent record, you might miss out on valuable learning opportunities, and those same mistakes can easily repeat. That’s where Flows.trading comes in; it offers a straightforward forex trading journal solution to simplify logging trades and provide helpful analytics.

This platform makes tracking entries, exits, and key metrics really efficient. By using Flows.trading, you’ll gain data-driven insights that can refine your strategies and ultimately boost profitability. Want to level up your FX performance? Check out flows.trading today!

What to Track in Your Forex Journal

So, you’re diving into the world of Forex trading – fantastic! One thing that separates successful traders from those who struggle is keeping a journal. Seriously, think of it as your personal growth tracker in the FX markets. It’s about more than just noting wins and losses; really dig into the specifics. What entry and exit prices did you get? How long was each trade open? Which currency pairs were you working with, and how much leverage did you employ?

Beyond that, it’s crucial to understand why you took a particular trade – was it a signal from technical indicators, fundamental analysis, or maybe reacting to some breaking news? Organizing your journal by setup, execution, and result makes reviewing past trades so much easier. This structured approach really helps spot patterns and pinpoint areas where you can level up.

Essential Data Points for Every Trade

Seriously, if you’re into Forex trading, keeping a journal is a game-changer! It’s about more than just recording entry and exit prices – think about noting down the reasoning behind each trade, your risk level, and leverage used. Consider it like reviewing film of yourself playing; that honest look back helps spot patterns and biases you might not realize exist. Plus, tracking those risk-reward ratios and stop-loss levels? That’s how you really refine your strategies and boost your Forex trading.

Currency Pair & Timeframe

Selecting a currency pair and timeframe is key when you’re diving into Forex. You’ll often find that popular, liquid pairs—like EUR/USD or GBP/JPY—offer tighter spreads and are easier to navigate. Consider your trading style; for example, scalpers might zoom in on one-minute charts, whereas day traders frequently use hourly ones. Swing traders? They tend to look at daily timeframes. Keeping a Forex trading journal is really helpful too – it lets you track what’s working and refine your approach.

Entry/Exit Prices & Lot Size

Understanding entry/exit prices is really important for Forex trading success. Your entry price is just what you pay to get into a trade, while the exit price shows if you’ve made money or taken a loss when you close it out. And don’t forget about lot size – that determines how much you’re actually trading; larger lots mean bigger potential gains (and risks!). For example, a 1.0 lot will cost more than a 0.1 lot. Keeping all this in mind can help keep costs down and improve your forex trading journal.

Stop-Loss & Take-Profit Levels

Managing risk is key when you’re trading Forex, and stop-loss and take-profit orders are vital tools for that! A stop-loss acts like a safety net – it automatically closes trades if prices move against you, limiting potential losses. Conversely, a take-profit secures your gains by exiting when you hit your target. Finding the sweet spot requires careful consideration of market movement and your overall strategy; don’t place them too tightly or widely spaced. Keeping track of these orders in your forex trading journal helps ensure you’re always optimizing.

Trade Duration

In Forex trading, how long you hold a position is called its duration. You’ll see many traders using day trading – just for hours – or swing trading, which can last several days to weeks. But position trading? That could be months, even years! Figuring out the best timeframe really depends on your analysis, strategy, and how much risk you’re comfortable with; shorter durations often mean more frequent trades, though potentially greater volatility too.

Qualitative Data: The "Why" Behind the Trade

Understanding why traders act is just as important as seeing what they do, isn’t it? Quantitative analysis gives us the numbers – profits, losses, and all that – but qualitative data digs deeper into the reasoning behind those choices. Exploring a trader’s mindset, emotions, and how much risk they’re comfortable with offers a richer perspective.

That’s why Forex trading journals really shine when they blend both approaches. Consider jotting down your motivations, observations about market sentiment, and reflections after each trade. Resources like Investopedias explanation on behavioral finance can help you refine this holistic view and boost your trading.

Reasoning and Strategy Used

Keeping a Forex trading journal is really helpful – it lets me track why I made each decision. Before jumping in, I always look at important price levels, economic news, and what might move the market. Managing risk is key; I carefully size positions and set stop-losses to protect my account. For a solid introduction to Forex, check out Investopedia’s guide. I adjust my strategies as needed and learn from past trades.

Technical Analysis Signals

Technical analysis offers traders a peek into what the market might do next! Tools like moving averages can reveal emerging trends, and the Relative Strength Index (RSI) helps identify when assets are potentially overbought or oversold. Plus, the MACD assists in spotting shifts in momentum – a bullish crossover, for example, could suggest it’s time to buy. Keeping a forex trading journal while using these techniques is really helpful for improving your results. https://www.investopedia.com/terms/t/technicalanalysis.asp

Fundamental Analysis Considerations

Fundamental analysis helps you really dig into potential investments—it’s about understanding the bigger picture. Think about things like economic growth, interest rates, and how a company stacks up against its competition. This approach can uncover opportunities aligned with your long-term financial goals. For forex traders especially, scrutinizing profitability, debt levels, and management quality offers crucial insights – vital for keeping a sharp forex trading journal.

Emotional State During the Trade (Fear, Greed, etc.)

Emotions definitely impact Forex trading – it’s something most traders experience! Perhaps fear pushes you to sell too soon, or maybe greed leads to impulsive decisions. Recognizing those emotional triggers—like unexpected market drops or winning streaks—is vital for staying focused when reviewing your Forex trading journal.

Taking a moment to ask yourself questions like, ‘What was I feeling then?’ and ‘Did I follow my strategy?’ can offer valuable insights. Tracking these feelings alongside trade specifics builds self-awareness and encourages disciplined habits, which ultimately leads to better results.

Outcome – Profit or Loss

Figuring out whether your Forex trades are actually making money – that’s a big deal for success! It’s really important to look at the results without letting emotions cloud your judgment. You’ll see both gross profit/loss, which is the initial gain or loss, and net profit/loss, which accounts for those pesky fees and commissions. Keeping things consistent with how you track each trade in your Forex trading journal will give you a clearer picture.

Good records help you find trends, tweak your strategies, and hopefully improve your win rate. So, be sure to track everything! Want to level up your tracking and potentially boost profitability? Check out tools like flows.trading – start journaling today!

Choosing a Trading Journal Method

Finding the right Forex trading journal method can really make a difference in your progress as a trader. There are quite a few ways to keep track of your trades, each with its own advantages. Digital spreadsheets offer tons of flexibility – they’re great if you’re comfortable using software and want to analyze data easily. If you’re serious about trading and crave detailed insights, specialized programs like flows.trading provide structured templates and automated reports; those are pretty handy! Alternatively, don’t discount the power of a good old-fashioned notebook. Surprisingly, writing things down by hand can encourage mindful reflection – it works well for many people. Ultimately, consider your comfort level with technology and how much detail you want to capture when deciding.

Manual Journaling vs. Software Solutions

Keeping a manual forex trading journal, whether it’s a notebook or a spreadsheet, can be really rewarding – it’s nice to see your progress! But let’s be honest, updating them takes effort, and digging into the data isn’t always easy. If you appreciate simplicity, that might work for you. However, forex trading journal software offers a faster way to log trades and provides powerful analytics too. Imagine automated charts and tools that track your performance – it’s all about boosting efficiency and uncovering those deeper insights to improve your strategy.

Pros & Cons of Each Approach

Choosing a trading approach really depends on your style! Day trading can be exciting with fast profits, but you’ll need to stay glued to the screen and accept higher risks. Swing trading offers more breathing room – potentially bigger gains over time – though it requires patience and might mean missing out on some quick opportunities.

Advantages of Dedicated Forex Journal Software like Flows.trading

Let’s face it, keeping track of Forex trades with spreadsheets or notebooks can be a real time sink. Wouldn’t it be nice to reclaim those hours? A dedicated Forex trading journal software, like Flows.trading, streamlines the whole process – logging your trades and instantly analyzing performance becomes much easier. Think about what you could do with that extra time! Plus, features such as automated risk/reward calculations and visual charting really elevate your trading game. With advanced analytics and backtesting at your fingertips, data-driven decisions become second nature. Ready to start tracking your progress effectively? Check out Flows.trading today.

Efficiency and Automation

Achieving consistent Forex trading success really comes down to working smarter, not harder! Automating those repetitive tasks—like placing orders or entering data—can save you a surprising amount of time and minimize errors. A streamlined workflow, often aided by a Forex trading journal, helps reduce mental fatigue so you can concentrate on analysis. Plus, automated risk management alongside consistent journaling provides valuable insights to refine your strategies and ultimately improve profitability.

Data Visualization and Reporting

Spotting trends in Forex trading data becomes so much easier with effective data visualization – it’s like gaining a clearer perspective! A Forex trading journal proves invaluable for uncovering patterns and identifying areas where you can improve. Regularly reviewing reports, whether daily or monthly, helps summarize your outcomes and manage risk, ultimately refining strategies to boost your win rate.

Analyzing Your Forex Trade Data

Really wanting to see consistent gains in Forex trading? Then digging into your Forex trade data is a must! A Forex trading journal can be a game-changer, helping you move beyond just feeling like you know what you’re doing and instead basing decisions on solid evidence. When you look back at past trades, try to stay objective – it’s easy to get caught up in emotions, but focus on the facts.

What patterns do you notice? What consistently leads to wins or losses? Consider both technical signals and how big economic events influence things. This systematic approach is really key to understanding what you’re doing well and where you can improve your strategy.

To track those FX trades effectively, keep a few things in mind: spotting repeating patterns, evaluating your risk management, and seeing how market volatility affects your results. Tools like https://flows.trading/trade-analysis/ can be super helpful for uncovering valuable insights – ultimately boosting profitability! Don’t forget to regularly review those journal entries; continuous refinement is the name of the game.

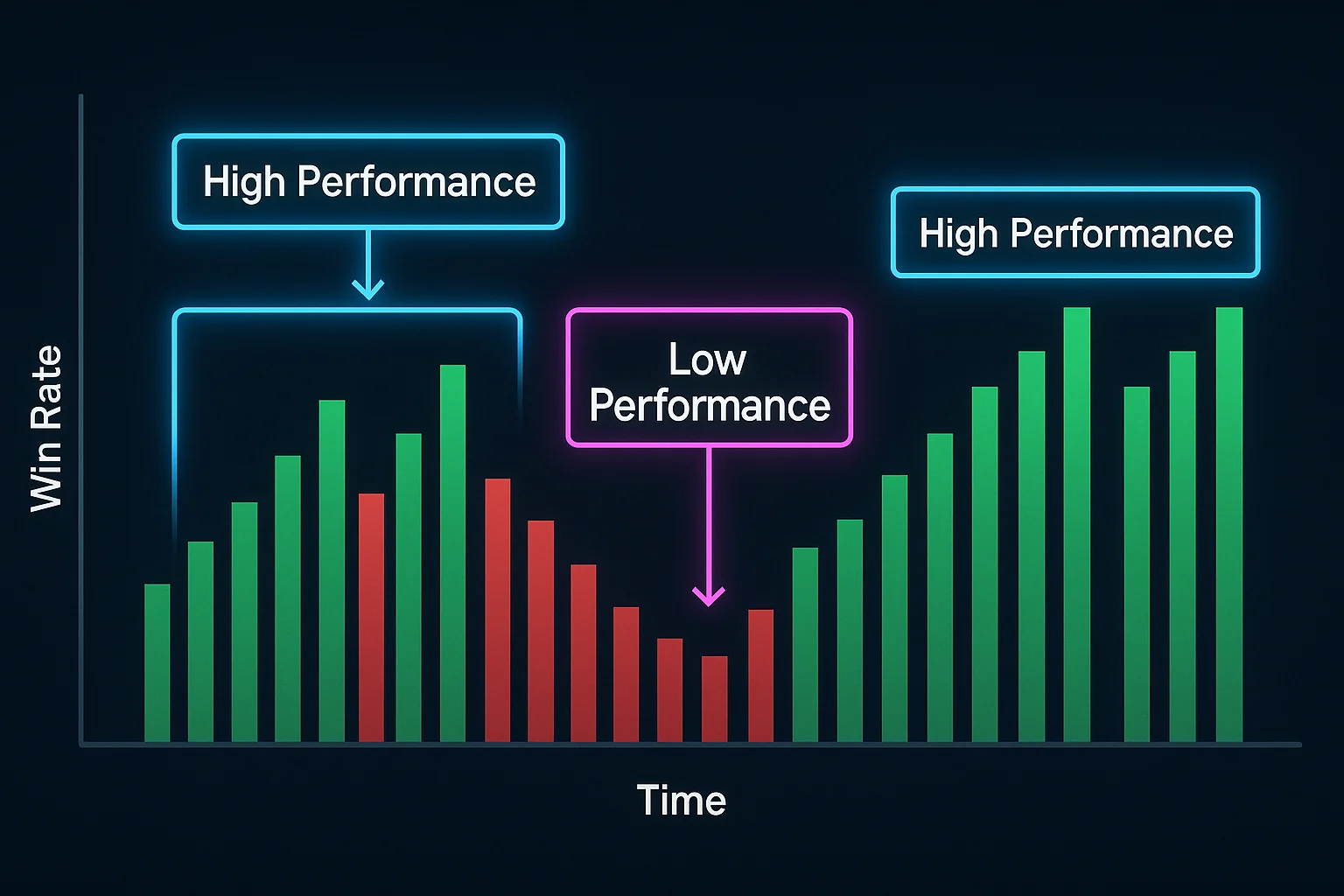

Identifying Patterns in Win Rates

Figuring out your win rates involves more than just counting wins and losses – it’s about the bigger picture! Think about what currency pairs you’re trading, when you usually trade, and how long those trades typically run. A good Forex trading journal is a real game-changer; it helps you notice patterns, both positive and negative, that impact your results. Really examine your performance – are some strategies consistently working well? On the flip side, do certain conditions often lead to losses? Your Forex trading journal can highlight these trends, so you can adjust your strategy for better outcomes.

Calculating Key Metrics (Win Rate, Average Profit/Loss)

Tracking your Forex trading journal is surprisingly vital! It’s really about understanding what’s working – or not. Calculating things like your win rate (how often you profit) and average gains/losses gives you a clear picture of how you’re doing. Think of it as having a detailed map to guide you through the market, helping pinpoint strengths and areas for improvement, ultimately boosting profitability.

Common Mistakes and Emotional Biases

It’s easy for Forex traders to slip up sometimes – things like not managing risk or missing key market shifts happen. Emotions can really cloud judgment; we’ve all been there, maybe falling prey to confirmation bias or that feeling of FOMO. These reactions often lead to quick decisions driven by a desire for reassurance and what others are doing.

To steer clear of these pitfalls, consider keeping a detailed Forex trading journal. Honestly recording your reasoning behind each trade – and how it played out – can reveal surprising patterns and biases impacting your performance. And remember, stop-loss orders and sticking to your plan are absolutely vital!

Recognizing Recurring Errors

Really, taking a close look at your Forex trading journal is key to getting better over time. It’s not just about marking down whether you won or lost; spotting those repeated mistakes can show you some interesting habits. For example, constantly reacting to news events might suggest needing more discipline in your overall strategy.

Profitable Strategies & High-Performing Trades

Achieving consistent profitability in Forex trading really comes down to having solid strategies and paying close attention to the markets. We focus heavily on managing risk – generally capping exposure at 2% of your capital per trade – and identifying those high-probability setups using tools like moving averages and Fibonacci retracements. Plus, consistent journaling is a game-changer; it lets you learn from every decision you make!

Take, for example, a recent short EUR/USD trade that yielded an impressive 35% return in just two weeks by riding a clear bearish trend. We also use flows.trading to keep an eye on order flow data, which helps us refine our entries and exits to maximize gains while keeping risk in check.

Spotting Consistent Winners

Really wanting to improve your Forex trading journal? It’s a fantastic starting point! Take a look at what’s happening – are there patterns in your winning trades? Maybe you find certain currency pairs consistently perform well, or specific times of day offer an advantage. Stepping back and looking objectively can reveal which strategies really work, helping build a stronger foundation.

Link to Flows.trading Trade Analysis

Ever feel like you’re missing something after each forex trade? Flows.trading can help! Our forex trading journal offers powerful analysis tools—think of it as a personal mentor guiding your progress. You’ll easily track market movements, assess your performance, and build custom reports to identify strengths and areas for growth. It’s all about refining strategies and increasing profitability. Want to level up your trading game? Start your free trial today!

Advanced Journaling Techniques

Leveling up your forex trading journal is about so much more than just jotting down trades—it’s about truly understanding why you do what you do. Think of it this way: after a win or a loss, try asking yourself “Why?” five times in a row. It’s like peeling back the layers of an onion to get to the core reason behind your actions! This kind of deeper self-reflection can really help you notice patterns that impact how you trade. A more structured approach offers far better insights than just free writing, and ultimately, it’s about improving your results.

Incorporating Risk Management Metrics

Want to level up your forex trading journal? Integrating risk management metrics is a fantastic way to do just that! It’s like reviewing the stats after a big game – tracking things like drawdown, win rate, and maximum losses shows you how well your strategy’s really performing. Consistently recording these details helps uncover patterns and potential weaknesses as time goes on.

Make sure to note entry/exit points and risk exposure with each trade. Analyzing this data can refine your approach, optimize those crucial stop-loss placements, and ultimately boost profitability. A solid forex trading journal really becomes an invaluable tool for continuous improvement – you’ll be amazed at what you learn!

Risk-Reward Ratio Calculation

Knowing the risk-reward ratio is essential for successful Forex trading. Essentially, it’s about balancing potential profits against possible losses – a straightforward calculation! Think of aiming for $100 in profit while risking just $30; that’s a 3.33 ratio, suggesting good reward potential. Generally, a ratio of 2:1 or better often points to a worthwhile trade. Keeping track of this in your Forex trading journal can significantly improve your results.

Drawdown Tracking and Analysis

For Forex traders, keeping a close eye on drawdown tracking is really important—think of it as monitoring the water level in your boat! Regularly checking your account equity and maximum drawdown helps you quickly identify potential risks. A Forex trading journal, where you record trade details and those drawdown figures, provides valuable insights. It’s also key to analyze why drawdowns occur – maybe due to market shifts or strategy adjustments—to improve your overall Forex trading experience.

Backtesting Ideas with Your Journal Data

Want to level up your forex game? Keeping a forex trading journal is surprisingly helpful! It’s like being a detective – you can look back at past trades, both wins and losses, to see what’s really working for you. Spotting those patterns reveals strengths and weaknesses. This lets you tweak your strategy based on real data, which ultimately leads to better results in forex trading.

Testing Strategy Variations

Keeping a forex trading journal isn’t just about looking back—it’s about moving forward too! Forward testing and paper trading really help; they let you peek at how your strategy might perform in real market conditions, which is more valuable than simply reviewing old data. Consider trying live trades with small amounts to fine-tune things and see if you can boost wins while cutting losses.

Refining Trading Strategies Based on Journal Insights

Keeping a Forex trading journal is surprisingly helpful for improving your performance. Taking the time to look back at your entries can highlight patterns – both good and bad! It’s not just about spotting them, though; really think about what you can do differently. For example, consistently losing money right before major news announcements might mean steering clear of trading around those times. This ongoing cycle of small tweaks, carefully tested, builds up to real progress over time. Why not start a journal today and take your Forex trading to the next level?

Common Forex Journaling Mistakes & How to Avoid Them

It’s surprising how many Forex traders skip the Forex trading journal, but doing so can really limit your progress. It’s tempting to just jot down wins and losses, like checking your bank account without seeing where the money went! A common pitfall is not documenting emotions or what was happening in the broader market alongside each trade. And if you don’t regularly review your journal entries, you miss out on valuable learning opportunities.

To get the most from it, really focus on analyzing your entry and exit strategies, how you manage risk, and even those tricky psychological factors. To truly leverage a Forex trading journal, remember to record every trade—seriously, every one! Be specific with your explanations; ditch the vague descriptions. Finally, regularly review past entries to identify patterns and biases. For more in-depth guidance on avoiding common mistakes, check out https://flows.trading/10-common-trading-journal-mistakes/. Ultimately, a well-kept journal transforms trading from guesswork into a data-driven process.

Inconsistent Tracking and Lack of Detail

It’s tricky to really analyze your Forex trades when tracking is inconsistent, isn’t it? Trying to spot patterns without good records feels like searching for shapes in a blurry photo! That makes improving your strategies tough – you might end up repeating mistakes and missing out on growth opportunities. A detailed Forex trading journal captures those crucial details; even remembering how you felt can reveal important insights. Ultimately, it’s about honest self-assessment and consistent progress within your Forex trading journal.

The Importance of Regularity and Thoroughness

Keeping a Forex trading journal is seriously helpful – it really does become a habit once you start! Jotting down when you get in and out of trades, plus why you made those choices and even how you felt at the time, builds up some great data. It lets you look back objectively and spot patterns in your decision-making, which can lead to much smarter trading moves.

Failing to Review Regularly

It’s easy to get caught up in the moment of Forex trading, but skipping regular reviews of your Forex trading journal? That can really hold you back! Think of it like driving without checking your rearview mirror – you’re bound to miss things. Consistent analysis helps avoid repeating errors and unlocks opportunities for growth.

Even just 15 minutes a week spent reviewing your journal can highlight areas where you’re struggling, sharpen your strategies, and boost your overall Forex trading performance. A dedicated journal is honestly key to long-term success in the market.

Scheduling Time for Analysis

Regularly reviewing your forex trading journal is a fantastic way to level up your skills! Think of it as routine maintenance – like checking your car’s oil—setting aside time daily or weekly to analyze your trades can reveal valuable patterns and areas for improvement. Scheduling dedicated slots helps ensure you stay disciplined and make smarter, more informed decisions.

Overlooking Emotional Factors

It’s easy for Forex traders to get caught up in the numbers, but don’t forget about emotions! Ignoring feelings like fear or greed can lead to impulsive choices that hurt your bottom line. That’s where a Forex trading journal really shines – it lets you objectively record trades and see just how much those emotions impacted your results.

Being aware of your emotional responses is crucial for minimizing their negative effects. Regularly reviewing your Forex trading journal can help you identify triggers and develop strategies for making more rational, data-driven decisions.

Recognizing the Impact of Psychology

Ever wonder how psychology impacts your Forex trading? It really does! Emotions like fear and greed can lead to quick decisions—and not always the best ones. A helpful trick is keeping a Forex trading journal; it’s a great way to notice those emotional patterns popping up, helping you develop calmer, more thoughtful strategies.

Link to Flows.trading 10 Common Trading Journal Mistakes

Want to level up your trading game? A Forex trading journal can be a real game-changer – think of it as having your own personal coach! It’s easy to fall into the trap of repeating past mistakes, which can really slow down progress. To help you learn faster and dodge those common pitfalls, we’ve put together a guide covering 10 frequent journaling errors.

Discover practical advice on keeping effective records at Flows.trading: https://flows.trading/benefits-of-keeping-a-trading-journal/. Ready to sharpen your strategy and boost profitability? Give it a look!

Conclusion

A Forex trading journal? It’s honestly one of the best things you can do if you’re serious about long-term success in FX markets. Consider it your personal record keeper – consistently noting down your trades allows you to take a step back and really analyze what’s working well, and where you might be going wrong. You start to notice patterns, both positive and negative, which lets you fine-tune your strategies. Being able to clearly review past decisions is absolutely key for growth.

Disciplined journaling builds self-awareness and encourages continuous improvement; it’s a powerful combination! Regularly reviewing your entries can really boost your win rate, minimize losses, and ultimately increase profitability. So embrace this practice – it’s truly a cornerstone for any Forex trader aiming to become more effective.

Key Takeaways: Consistent Journaling for Success

Keeping a forex trading journal is surprisingly powerful for steady progress – it’s like having your own personal coach! It really helps you notice patterns in your trades, both wins and losses. Plus, journaling encourages honest reflection on how emotions influence your choices, letting you tweak your strategy based on real data. You’ll uncover those sneaky blind spots and learn much faster, which is key for long-term forex trading journal success.

Why not start with just 15 minutes a day to jot down your trades – why you got in, why you got out, and how you were feeling? A quick weekly review can reveal helpful trends. Tools like flows.trading make it easier; even short entries can bring big improvements.

Encouragement to Start Your Journey with Flows.trading

Thinking about boosting your forex trading game? Flows.trading offers a really simple, intuitive way to start journaling those FX trades – you can jump right in! It’s easy to track how you’re doing, notice patterns emerging, and tweak your strategies without any complicated setup.

Creating a solid forex trading journal has never been so straightforward. Our platform helps you uncover valuable insights and refine your approach. Ready to unlock your full potential? Head over to flows.trading today!