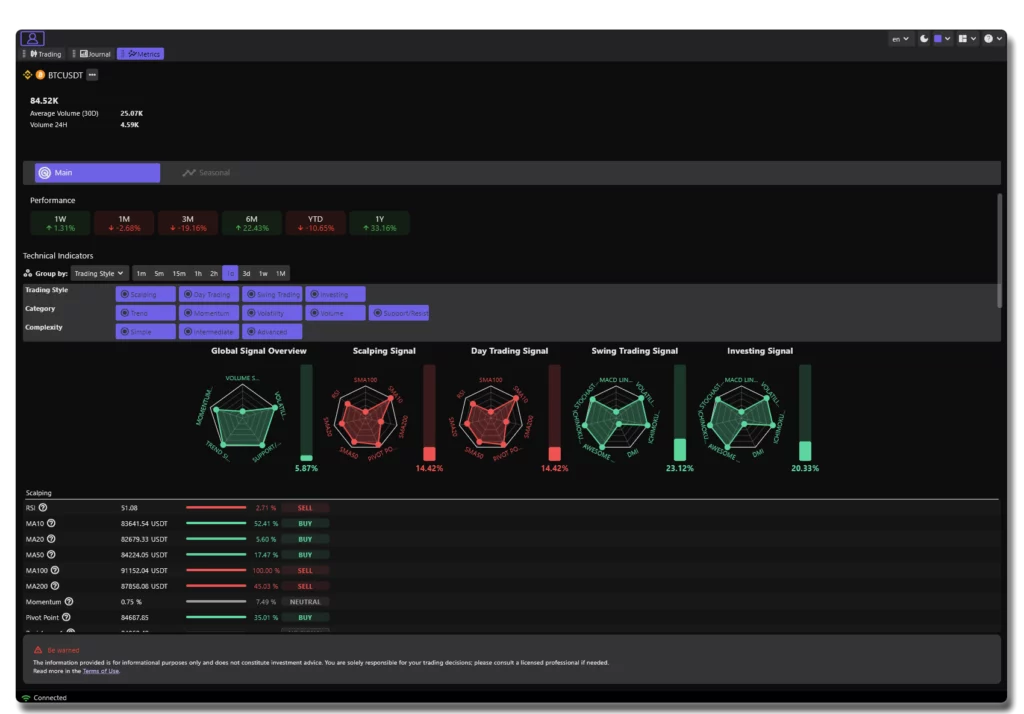

The Main Signal Dashboard is the core of the Trading Signals feature.

Its goal is simple: help you understand what the market is doing right now, from multiple perspectives, in seconds.

This page explains:

What the Main dashboard shows

How to configure it

How to read each part

In which context it’s most useful

How different traders can use it

What the Main Dashboard Is #

The Main dashboard is a real-time technical analysis assistant.

It groups dozens of indicators into a single view and organizes them according to:

Trading Style

Scalping – Day Trading – Swing Trading – InvestingCategory

Trend – Momentum – Volume – Volatility – Support/ResistanceComplexity

Simple – Intermediate – Advanced

You get a complete and structured overview of the technical health of the asset, without having to study every indicator manually.

Instead of “What does the RSI say? What does the MACD say? What about moving averages?”, you get:

A combined interpretation of all of them, tuned to your trading style.

Configuring Your Signal View #

At the top of the panel, you can adjust four essential settings:

1. Group By #

This changes how indicators are visually organized.

You can group them by:

Trading Style

Category

Complexity

Timeframe

This lets you switch between:

A trader-style view (“What’s best for scalping right now?”)

A technical view (“Show me all momentum indicators together”)

A skill-level view (“Show only simple indicators”)

2. Trading Style Filters #

You can toggle:

Scalping

Day Trading

Swing Trading

Investing

Each style uses a different set of indicators and weightings.

For example:

Scalping focuses on speed, volatility and ultra-short-term direction.

Investing cares about long-term trend stability and macro strength.

3. Category Filters #

To focus your analysis on what matters most:

Trend indicators

Momentum indicators

Volume indicators

Volatility indicators

Support/Resistance

This is useful if you want to answer a specific question like:

“Is the trend strong enough?”

“Is volume confirming this move?”

“Is momentum aligned with direction?”

4. Complexity Filters #

Choose the type of indicators you prefer:

Simple (SMA, RSI, etc.)

Intermediate (MACD, DMI…)

Advanced (Ichimoku, Parabolic SAR…)

This is perfect for beginners who want a clean, simple view—or experts who want full detail.

How to Read the Dashboard #

The dashboard is divided into several functional areas.

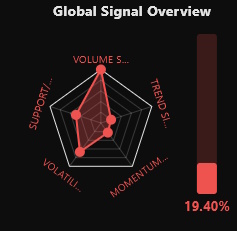

1. Global Signal Overview #

A radar/spider chart showing the combined strength of:

Trend

Momentum

Volume

Volatility

Support/Resistance

The center = weaker signal.

The outer edge = stronger signal.

This allows you to instantly gauge:

Whether the asset is trending or ranging

Whether momentum is building

Whether volume is confirming moves

Whether volatility is supportive or chaotic

A strong and balanced shape means strong alignment.

A deformed or mixed shape means a choppy or uncertain market.

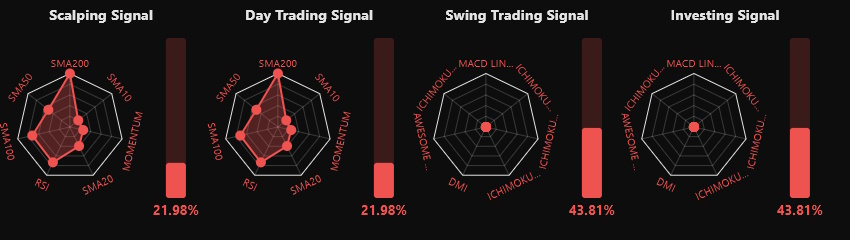

2. Style-Specific Signals #

Each trading style gets its own signal card:

Scalping Signal

Day Trading Signal

Swing Trading Signal

Investing Signal

Each signal represents the combined result of the indicators used for that style.

The percentage bar on the right shows:

The strength of the signal

How bullish or bearish the setup is

This helps you quickly answer:

“Is today a good environment for this trading style?”

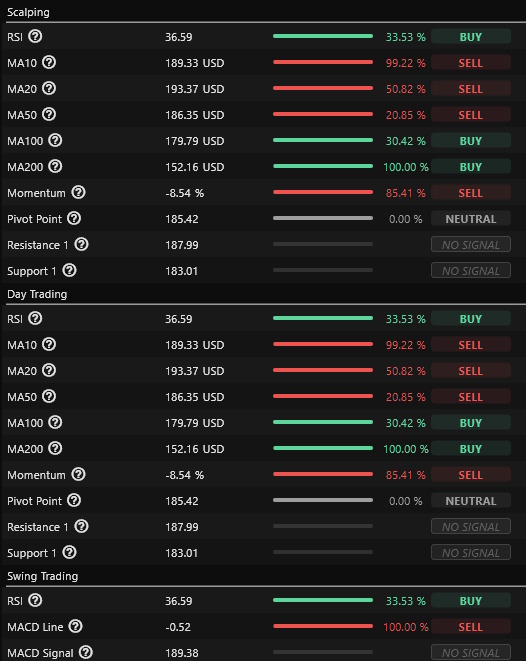

3. Indicator Table #

Below the signals, you will find the detailed indicator list, showing:

Indicator value

Signal direction (Buy/Sell)

Strength (%)

Group (trend, momentum…)

This gives transparency and lets you understand exactly why the signal has a certain score.

You can see:

Which indicators agree

Which indicators disagree

Whether the signal is driven by trend, momentum, or volume

How to Use the Main Dashboard Effectively #

1. Preparing a Trade #

Before entering:

Check your trading style’s signal

Confirm trend or momentum strength

Verify that indicators are aligned

Evaluate volume confirmation

If signals disagree or alignment is weak, you may want to wait for better conditions.

2. Validating Your Bias #

If you have a trading idea (“I think this will go up”), use the signals to confirm or challenge it.

Example:

Trend strong

Momentum rising

Volume supportive

→ The setup is solid.

Or:

Trend strong

Momentum falling

Volatility increasing

→ Be cautious; conditions may turn.

3. Monitoring an Active Trade #

When you’re in a position:

Check if your signal stays aligned

Watch for momentum weakness

Track volume drying up

Anticipate reversals

This helps you manage exits with more discipline.

Which Type of Trader Should Focus on What? #

Scalpers #

→ Watch momentum + volatility.

→ Focus on 1m, 5m timeframes.

→ Look for synchronization across short-term indicators.

Day Traders #

→ Monitor trend + momentum.

→ Use intraday timeframes (15m–2h).

→ Confirm with volume.

Swing Traders #

→ Focus on trend alignment + support/resistance.

→ Use multi-day signals (1d–1w).

→ Look for stable setups, not fast spikes.

Investors #

→ Look at long-term trend + global signal shape.

→ Ignore intraday noise.

→ Seek alignment across higher timeframes.

Summary #

The Main Trading Signal Dashboard helps you:

Understand the market instantly

Configure signals to match your trading style

Analyze trends, momentum, volume, volatility together

Make better, faster, more confident decisions

Validate or challenge your trade ideas

Build discipline in your strategy

It’s a powerful, flexible, and intuitive tool built for traders of all experience levels.