Different traders see the market in different ways.

That’s why Flows.Trading offers a range of chart types, each designed to emphasize a specific aspect of price movement — from clarity to volatility to momentum.

Being able to switch chart types isn’t just about visual preference; it’s about adapting your analysis.

A line chart can simplify noisy price action, while a candlestick chart reveals rich intraday structure.

Choosing the right type helps you focus on what matters for your trading style.

Changing the Chart Type #

The current chart type is displayed in the Chart Type selector located in the top toolbar, next to the chart symbol field.

To change the chart type:

- Click the Chart Type icon (🕯️).

- A dropdown menu appears with all available chart styles.

- Select a chart type — the main price pane updates instantly.

💡 Tip: You can switch freely between chart types without losing your drawings or indicators.

Choosing the Right Chart Type #

There’s no single “best” chart type — the right one depends on your strategy and what you’re trying to see.

| Objective | Recommended Type | Why |

|---|---|---|

| Identify price patterns | Japanese Candlesticks | Shows full OHLC detail for structure analysis |

| Focus on overall trend | Line or Area | Simplifies noise, highlights direction |

| Spot trend momentum | Heikin Ashi | Smooths volatility, shows directional flow |

| Compare session volatility | OHLC / Hollow Candles | Emphasizes range and relative movement |

| Visualize discrete changes | Step Line | Highlights jump points and pauses |

💡 Pro Tip: Combine chart types across layouts — for example, view Candlesticks on your main chart and Heikin Ashi on a secondary chart to validate trend alignment.

Below is the list of chart types currently supported in Flows.Trading, with a short description and suggested use cases.

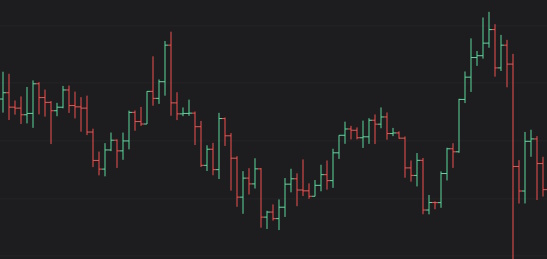

Japanese Candlesticks (default) #

Description:

The most popular chart type among traders. Each candle shows four price points: Open, High, Low, and Close.

Candlestick colors represent whether price rose (bullish) or fell (bearish) during that period.

When to use:

Ideal for price action analysis and pattern recognition (e.g., engulfing, doji, hammer).

Use for both intraday and swing trading, when you need precise entry/exit visualization.

Hollow Candlesticks #

Description:

A visual variant of candlesticks. Hollow bodies represent periods that closed higher than the previous close, filled bodies represent lower closes.

When to use:

Great for momentum tracking — you can quickly spot continuation or reversal in trend strength.

Preferred by traders who like clean visuals with less color saturation.

Line Chart #

Description:

Displays only the closing price for each interval, connected by a line.

Removes intraperiod noise and highlights the overall price trajectory.

When to use:

For macro-level analysis and trend confirmation.

When you want a cleaner, less volatile view of market direction.

💡 Tip: Perfect for zoomed-out or higher timeframe analysis.

Line with Markers #

Description:

Same as a standard line chart, but adds small markers at each close to highlight each data point.

When to use:

When you want a precise view of each close while maintaining the simplicity of a line chart.

Useful for backtesting or manual trade journaling, where each close matters.

Step Line #

Description:

Shows a line that moves horizontally and vertically, connecting each close in a “step” pattern.

This makes it easier to visualize price changes between discrete intervals.

When to use:

When analyzing price stability or sudden jumps.

Helpful for assets with irregular trading activity or range-bound movement.

Area Chart #

Description:

A line chart with the area below the line filled with color.

Emphasizes the magnitude of price movement over time and provides a smoother, more visual impression of momentum.

When to use:

For visual summaries or when presenting data.

When you want a quick visual sense of direction and intensity.

OHLC Bars #

Description:

Each bar displays the same information as a candlestick (Open, High, Low, Close) but using vertical lines and ticks rather than filled bodies.

When to use:

For traders who prefer a minimalist, old-school representation.

Often favored in institutional or legacy charting systems.

OC / HL Bars #

Description:

Variants of the OHLC bar format that focus on different subsets of data:

OC: Open and Close only.

HL: High and Low only.

When to use:

For specific data analysis tasks, when you only want to see a certain aspect of market structure.

Useful in performance diagnostics or algorithmic comparisons.

Heikin Ashi #

Description:

A smoothed version of candlesticks. Each candle is calculated using the previous candle’s values, which filters noise and highlights trend direction.

When to use:

Ideal for identifying trend strength and reversals.

Great for visual clarity in trending markets, as small fluctuations are averaged out.

💡 Note: Heikin Ashi modifies the candle calculation — it’s best for analysis, not for exact entry/exit price tracking.