Placing orders in Flows.Trading is designed to be fast, intuitive, and fully compatible with the capabilities of your connected broker. This page explains all available ways to open the order window, all order types (with clear explanations of when and why to use them), and advanced features such as automatic price/quantity conversion.

1. Opening the Order Window #

You can open the order panel in three different ways, depending on how you prefer to trade.

From the Chart (fastest method) #

On the chart, you will see two floating buttons:

![]()

Green button → Open a Buy order

Red button → Open a Sell order

This is the fastest method and is ideal for active traders who monitor price action directly on the chart.

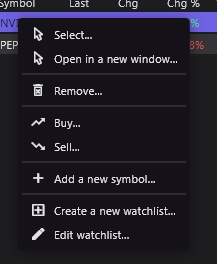

Right-Click on the Chart → Buy / Sell #

A right-click anywhere on the chart opens a context menu, which includes:

This method is convenient for traders who use many drawing tools or work directly with chart interactions.

From the Watchlist #

Right-clicking on any symbol in your Watchlist displays another context menu:

This is useful when monitoring multiple assets at once.

2. Order Types Explained #

⚠️ Important: The available order types depend on your broker.

Flows.Trading only displays the types supported by your active broker connection.

Each order type below includes:

A short explanatory introduction

When to use it

How it behaves

🟦 Market Order #

A Market Order executes immediately at the best available price. It prioritizes speed over price control and sends your order directly into the market without restrictions.

When to use a Market Order #

When immediate execution is more important than the exact price

During fast-moving markets

When entering or exiting a position urgently

When trading with high liquidity

How it behaves #

Executes instantly

Does not guarantee an exact execution price

May incur slippage during volatility

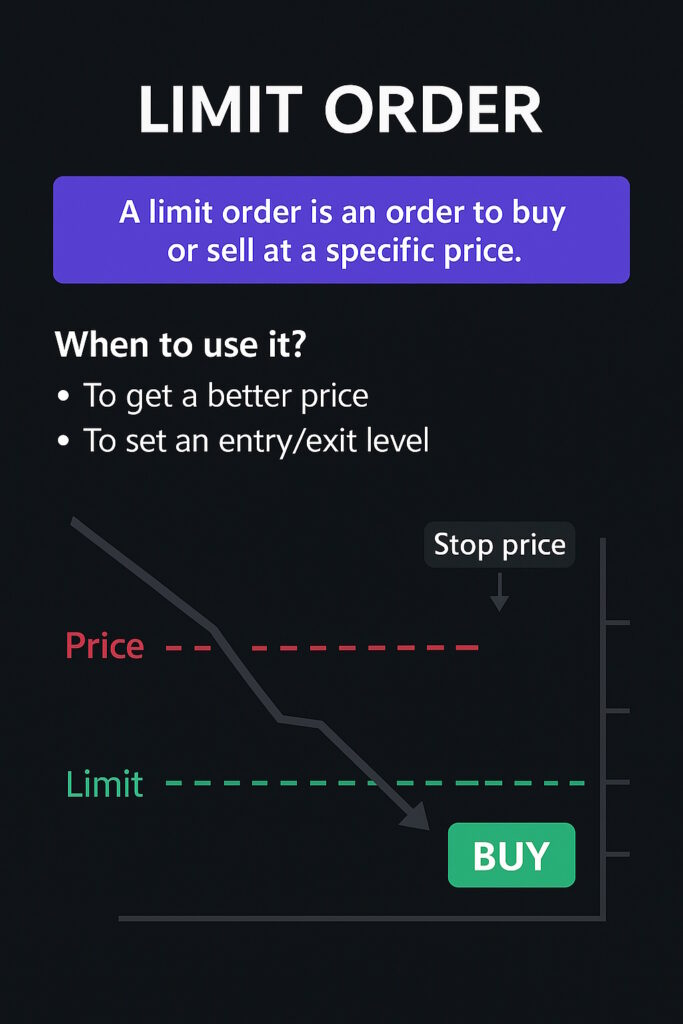

🟪 Limit Order #

A Limit Order lets you specify the maximum price you are willing to pay (for a Buy) or the minimum price you are willing to accept (for a Sell).

It offers precise price control and is ideal for patient and strategic trading.

When to use a Limit Order #

When you want a better price than the current market

For planned entry levels (support/resistance)

For passive trading strategies

When you want to avoid slippage

How it behaves #

Executes only if the price reaches your limit

Buy Limit → must be below the current market price

Sell Limit → must be above the current market price

Order remains pending until triggered or canceled

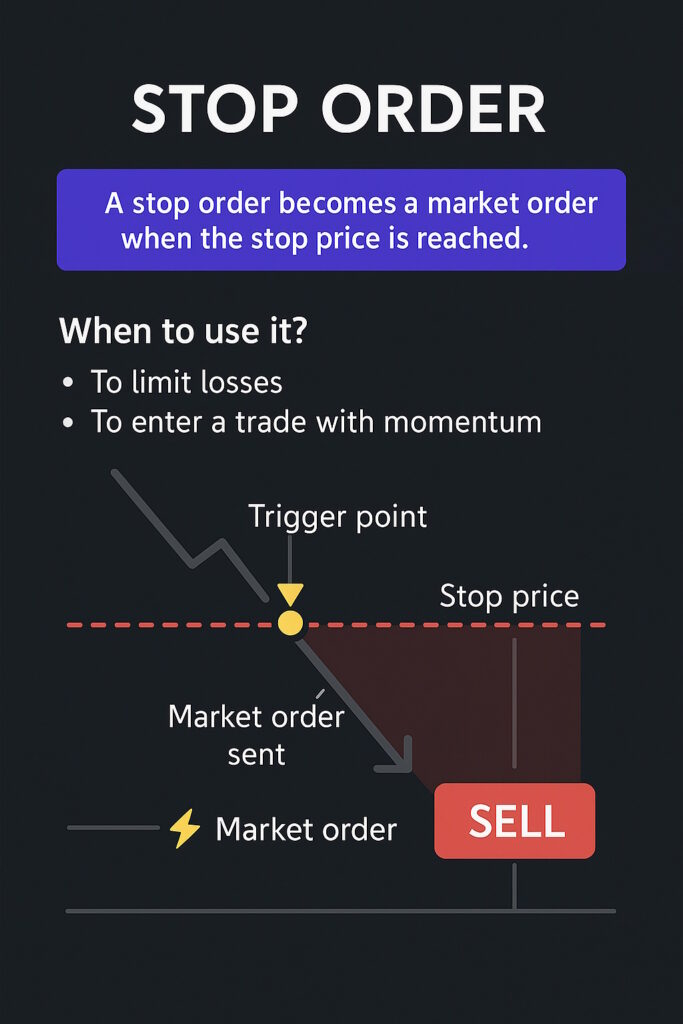

🟥 Stop Order #

A Stop Order becomes active only when the market reaches your stop price. It is typically used to catch breakouts or protect positions when the price moves against you.

When to use a Stop Order #

To enter during a trend continuation (breakout strategy)

To catch momentum after a key level is broken

To manage risk by triggering an exit when a critical price is reached

To automate entries without constantly watching the chart

How it behaves #

Converts into a Market Order once the stop price is reached

Buy Stop → stop price must be above the market

Sell Stop → stop price must be below the market

If set incorrectly, Flows.Trading will show a clear validation error

🟥 Stop-Limit Order #

A Stop-Limit Order combines the trigger mechanism of a Stop Order with the price control of a Limit Order.

Once the stop price is reached, the system places a Limit Order instead of a Market Order.

When to use a Stop-Limit Order #

For breakout entries where you want price confirmation

When you want to avoid slippage after the stop is triggered

When your broker or strategy requires precise execution

When protecting a position but avoiding market orders

How it behaves #

Stop price triggers the order

Limit price defines the acceptable execution range

Buy Stop-Limit → stop and limit above market

Sell Stop-Limit → stop and limit below market

Execution is not guaranteed if the limit cannot be matched

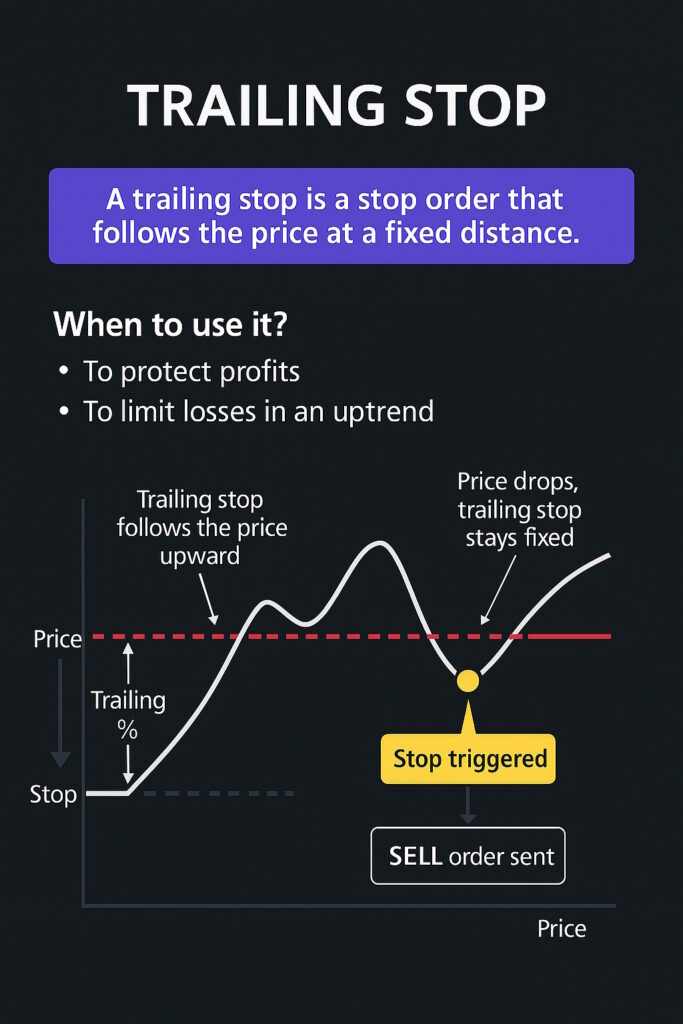

🟧 Trailing Stop Order #

A Trailing Stop is a dynamic stop order that automatically moves with the price.

It allows profits to run while securing gains as the trade evolves.

When to use a Trailing Stop #

For trend-following strategies

To protect profits without manually adjusting your stop

To remove emotions from your exit strategy

To ride large moves with minimal risk

How it behaves #

You specify a percentage or amount of distance (depending on broker)

As the price moves in your favor, the stop follows automatically

If the price reverses, the stop remains fixed and triggers normally

Particularly powerful for longer moves or volatility trading

3. Additional Options: TP, SL & Limit Extensions #

Every order panel contains optional execution rules:

Take Profit

Stop Loss

With Limit (broker-dependent)

These allow you to fully configure your risk management at the moment you open the position, ensuring a safer and more structured workflow.

4. Automatic Conversion (↔ Symbol) #

Flows.Trading includes a powerful automatic conversion tool found inside each input field (price, quantity, amount…).

A small icon with two arrows ↔ appears next to the field.

What the conversion button does #

It instantly converts the value you entered into:

the required currency

the correct unit

or the proper input format used by your broker

using live market data and available conversion rates.

Why this feature is essential #

Eliminates manual calculations

Prevents costly input mistakes

Saves time when trading multi-currency or multi-asset markets

Ensures compliance with broker requirements

Makes order placement more fluid and beginner-friendly

This feature is one of the most valuable tools in Flows.Trading, especially for traders who frequently switch instruments, brokers, or currencies.

5. Input Validation & Error Handling #

Flows.Trading automatically checks the validity of every order:

Whether the stop/limit price is allowed

Whether the order type matches broker rules

Whether the price belongs on the correct side of the market

Whether required fields are completed

Examples of validation messages:

“The stop price must be smaller than the actual market price.”

“Stop-Limit: limit must be compatible with the stop price.”

“Invalid quantity.”

This ensures clean, reliable, and safe order placement at all times.

6. Practical Trading Recommendations #

✔️ Scalpers #

Use Market Orders + preconfigured TP/SL for the fastest execution.

✔️ Swing Traders #

Prefer Limit or Stop-Limit orders for precise price control.

✔️ Breakout Traders #

Use Buy Stop, Sell Stop, or Stop-Limit for confirmation entries.

✔️ Risk-Managed Trading #

Always configure at least a Stop Loss and Take Profit.

✔️ Multi-Currency Traders #

Use the ↔ automatic conversion systematically.

7. Summary #

Flows.Trading provides a complete, flexible, and intuitive order placement system.

Between fast chart buttons, context menus, advanced order types, and automatic conversions, the platform adapts to every trading style—from scalpers to long-term analysts.