Seasonality is one of the most overlooked yet powerful concepts in trading.

While indicators show what is happening right now, seasonality reveals something different:

How the asset tends to behave at specific times of the year, historically.

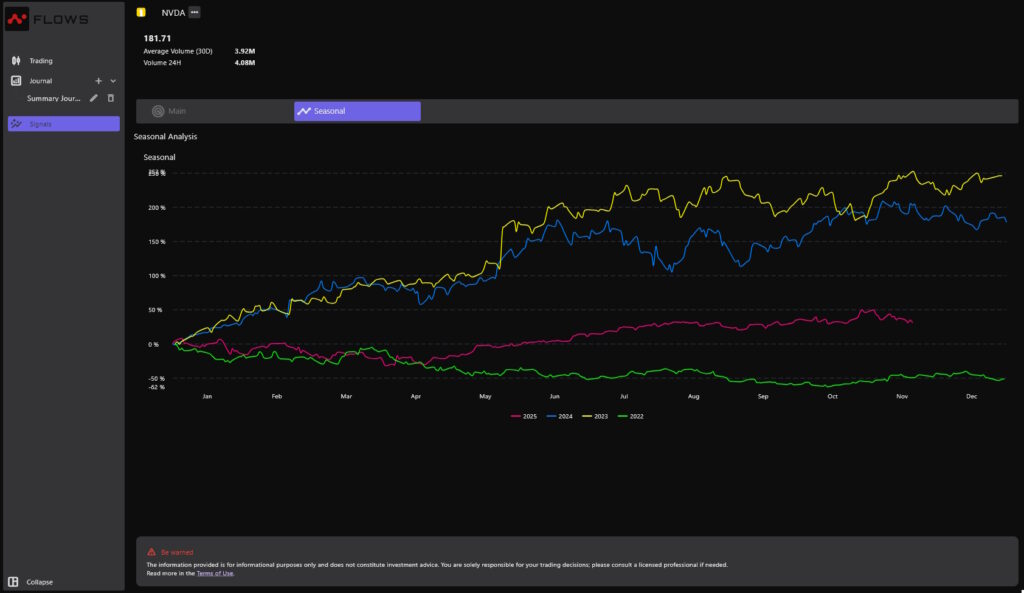

The Seasonal tab analyzes several years of price data and plots the average performance of the asset across the calendar year.

It helps you see patterns, tendencies, recurring strengths, and recurring risks—at a glance.

This page explains how to read the Seasonal view, why it matters, and how to integrate it into your trading.

What Seasonal Analysis Is #

Seasonality refers to recurring price behaviors that repeat year after year.

These patterns can be driven by:

Earnings cycles

Macro-economic cycles

Industry-specific cycles

Consumer behavior

Tax deadlines

Market psychology

Historical performance drivers

Not all assets have strong seasonality.

But when they do, it can provide incredible context.

Example:

Some tech stocks historically perform well in Q4 due to holiday spending.

Some commodities perform strongly in specific months due to supply/demand cycles.

Seasonality does not predict the future—but it reveals statistical tendencies that can help you make more informed decisions.

How the Seasonal Tab Works #

The Seasonal tab plots several past years of performance on a single chart.

Each line represents a complete year, normalized to percentage change from January 1st.

For example:

Yellow = 2023

Blue = 2024

Pink = 2025

Green = 2022

This lets you instantly compare:

How this year behaves vs. previous years

Whether the asset usually rises or falls during a period

If current performance deviates from the historical pattern

Whether seasonal strength or weakness is coming soon

The chart aligns all years on the same January-to-December timeline to highlight calendar-based patterns.

Why Seasonal Analysis Matters #

Seasonality provides context and confidence when making decisions.

✔️ 1. Identify High-Probability Periods #

Some assets historically:

Rally between March and June

Struggle in September

Surge in Q4

Dip during earnings cycles

If several years show the same pattern, it increases the probability of repetition.

✔️ 2. Spot Unusual Behavior #

If this year’s curve diverges from historical trends, something interesting is happening:

A macro shift

A major catalyst

A break from normal investor psychology

This can be a signal of opportunity or caution.

✔️ 3. Improve Timing #

Even if your technical analysis shows a bullish trend, seasonality tells you:

Whether it’s the right time of year to expect continuation

Whether a pullback is statistically common

Seasonality = timing intelligence.

✔️ 4. Strengthen Trade Validation #

You see:

Trend (Main tab)

Signal alignment (Indicators)

And now historical behavior (Seasonal)

When all three align:

Probability improves dramatically.

How to Read the Seasonal Chart #

Each colored line = one historical year #

They all start at 0% on January 1st, then show how that year progressed.

Key things to look for: #

1. Recurring patterns #

Do several years rise at the same time?

Do several years dip in September?

Is summer usually flat?

2. Outlier years #

If one year behaves very differently, was it due to:

A crash

Extraordinary news

Market shocks

Understanding outliers gives context.

3. Current year vs. history #

If the current year is:

Above historical curves → stronger-than-usual market

Below them → underperformance

In line → normal behavior

This adds meaning to today’s price action.

Practical Use Cases #

Scalpers #

Scalpers use seasonal analysis indirectly:

It helps identify high-volatility months

It warns about months with historically weak movement

This lets scalpers adjust expectations and risk.

Day Traders #

Day traders can:

Focus on trending periods

Avoid historically choppy zones

Understand context behind recent volatility

Example:

If an asset historically performs poorly in September, day traders can be more conservative.

Swing Traders #

Swing traders benefit massively:

Seasonal strength improves trend-trading probability

Seasonal weakness warns of upcoming pullbacks

Helps avoid swing entries during historically flat months

Example:

If NVDA historically rallies from March to June, swing traders focus long entries during that period.

Investors #

Long-term investors use seasonality to:

Accumulate during historically weak months

Add aggressively in historically strong quarters

Compare multi-year performance for trend health

Seasonality becomes part of macro timing.

Example Scenarios #

Example 1 — Strong Spring Seasonality #

If 2022, 2023, and 2024 all show a strong uptrend between March and June:

Consider long setups with extra confidence

Watch for early signals in late February

Expect volatility and opportunity

Example 2 — Repeated September Weakness #

If every year dips in September:

Avoid aggressive entries

Tighten stops

Prepare for cheaper prices

Expect quieter growth

Example 3 — Current Year Breaking Pattern #

If the current year suddenly outperforms historical curves:

A new catalyst may be in play

Trend may be stronger than usual

Consider leaning into momentum (with risk management)

If the current year underperforms:

A structural weakness or external event is suppressing the stock

Be cautious with bullish setups

How to Combine Seasonal + Technical Signals #

Seasonality + Signals = Smart timing + Strong confirmation.

Best Use Cases: #

Find seasonal strength → verify signals in the Main tab

See seasonal weakness → wait for stronger confirmation before buying

Identify periods where technical signals are more reliable

Anticipate when trend signals may gain strength

Avoid risky trades during historically flat or choppy periods

Example:

Seasonal: “Historically bullish in June”

Main tab: Trend + momentum turning bullish

→ High-probability long setup

⚠️ Important Reminder #

Seasonality provides historical tendencies, not predictions.

Always combine seasonal data with:

Signals

Chart structure

Volume

Volatility

Risk management

It is a context tool, not a certainty tool.

Final Thoughts #

The Seasonal tab gives you:

A unique view of yearly behavior

Context that most traders completely ignore

Better timing

Better trade filtering

More confidence when signals align

Use it to understand how the asset behaves through the year, not just how it behaves today.