Trading Journal Template vs. Software: Which Should You Choose?

Table of Contents

Why Trading Journals Matter: A Trader's Secret Weapon

A trading journal can be a real game-changer for traders – often missed, but surprisingly powerful! It’s far more than just noting wins and losses; picture it as a fantastic tool for self-reflection and continuous improvement. Consistently writing down your trades—entry and exit points, why you made those decisions, how you were feeling at the time, and what the market was doing—can uncover some really interesting patterns in both your actions and strategy effectiveness.

Ever find yourself consistently making rushed choices or overlooking key support levels? A trading journal can help illuminate these blind spots! Regular review builds discipline and objectivity; think of it as an investment in your future success, a personalized roadmap guiding you toward becoming a more skilled and profitable trader. Seriously, don’t underestimate the impact this simple practice can have.

The Power of Self-Reflection in Trading

Becoming a successful trader really hinges on self-reflection, doesn’t it? It’s about taking the time to look back at your trades – both those wins and losses – and honestly assess how you made those decisions. Shifting focus from just the outcome to understanding your process can uncover some surprisingly valuable patterns. A trading journal, whether a simple notebook or dedicated software, makes this review so much easier.

Consider asking yourself: What sparked that trade in the first place? Could I have managed risk better? These insights are incredibly helpful for refining strategies and gaining emotional control. Why not start tracking your trades today – it’s a really vital step towards consistent profitability!

Common Pitfalls Without Journaling

Ever notice how easy it is to forget why you made certain trading choices? Without a trading journal, spotting those recurring patterns—and avoiding repeated mistakes—becomes really tricky. Plus, managing the stress of trading can be tough without somewhere to process your emotions. Really understanding why trades work or don’t? That clarity often gets lost too.

How Consistent Journaling Improves Results

Consistent journaling can really unlock better outcomes! Consider a trading journal like a personal logbook – regularly documenting your trades encourages some valuable self-reflection. It’s amazing how it helps you spot patterns, revealing what works and what doesn’t, including any biases or strategies needing adjustment. This ongoing review is key to continuous improvement.

What is a Trading Journal and Why Do You Need One?

Ever wonder how professional traders consistently improve their results? A trading journal is often the secret weapon! Think of it as your personal logbook – a detailed record of every trade you make, capturing everything from entry and exit prices to why you made those decisions. It’s even helpful to note down how you were feeling at the time, and whether the trade ended up being profitable or not.

Why bother? Well, regularly keeping a trading journal allows you to identify patterns in your behavior and strategy. Perhaps losses frequently occur during specific market conditions, or maybe certain setups consistently lead to wins. By analyzing these past trades, you can refine your approach, minimize biases, and ultimately improve your profitability – regardless of how much experience you have. It’s truly a crucial tool for continuous growth.

Defining the Purpose of a Trading Journal

Think of a trading journal as your own personal trading coach – pretty neat, right? It’s an incredibly useful tool for anyone looking to improve their skills. Essentially, you’re documenting each trade: why you made the choice, and what the outcome was. This detailed record helps reveal patterns in your trading; maybe you consistently succeed with certain strategies or perhaps some habits are hindering your progress. Spotting these things leads to much smarter decisions down the road!

Key Elements to Track (Beyond Just Profits/Losses)

Really diving into your trading can be tough, right? A good trading journal isn’t just about marking whether you won or lost; it’s a powerful tool for understanding why those outcomes happened. Think of tracking things like how often you trade, what percentage of trades are winners, and the average profit or loss – that data reveals where you can level up. Plus, jotting down your feelings and what was happening in the market adds so much context! Whether it’s a basic spreadsheet or specialized software, keeping a trading journal is key to getting better. Ready to boost your trading? Start tracking those trades now!

Examples: Entry/Exit Points, Risk-Reward Ratio, Emotions, Market Conditions

Successful trading really comes down to sticking to a plan – kind of like baking a cake! Imagine setting an entry point at $100 with the goal of selling when it hits $110; that’s a 1:2 risk-reward ratio. It’s also vital to manage those emotions, avoiding impulsive decisions driven by fear or excitement. Plus, understanding market conditions, like whether things are trending upward, will shape your approach. And don’t forget to adjust your stop-loss when news creates volatility! Keeping a trading journal helps you spot patterns and improve future entry points.

The Manual Approach: Trading Journal Templates (Spreadsheets & Notebooks)

If you like getting your hands dirty in the markets, manual trading journal templates offer a fantastic alternative to relying solely on software. It’s really about keeping a detailed record of each trade—think of it as a personal log without all the digital clutter! A simple spreadsheet can easily handle tracking details like entry and exit times, the assets you were trading, your position size, and naturally, whether you made a profit or loss. Even a notebook works great; just aim for neat handwriting and consistent formatting.

This approach really encourages mindfulness because it forces you to consciously document every decision. Plus, it’s wonderfully accessible offline, which can help you truly understand why you made those choices in the first place. You could even use bullet points to quickly jot down key observations or how you were feeling during a trading session. Ultimately, whether you choose digital or paper, a well-maintained journal is an invaluable tool for spotting patterns and refining your overall strategy.

Pros of Using Templates

Templates can be seriously helpful for traders looking to level up their game. A trading journal template, for example, is like a shortcut – you skip all the tedious setup and get right to recording your trades! That saves time and frees up brainpower so you can focus on analyzing markets instead of shuffling papers; it’s a real productivity boost. And because templates offer a consistent format, spotting patterns in your trading becomes much easier, leading to some really valuable insights.

Cost-Effectiveness and Accessibility

Want to level up your trading game? Our trading journal software makes tracking and analyzing trades surprisingly simple – a truly smart investment! Many of our clients experience an impressive 15% performance boost, thanks to clearer strategies and fewer costly mistakes. We’ve designed it with everyone in mind, offering tiered pricing and an intuitive design that’s easy to pick up. Plus, you can access everything on the go!

Customization Options for Specific Strategies

A truly effective strategy implementation feels like a custom-tailored suit – it needs that perfect fit! Think about trend-following strategies; you can adjust them by tweaking timeframes or adding volatility filters to match your client’s risk tolerance. Backtesting different settings is key for optimizing performance and hitting those campaign goals, wouldn’t you agree?

Don’t forget parameter tuning, dynamic position sizing, and even incorporating external data feeds. Keeping a robust trading journal allows you to track changes and see their impact – it’s all about continuous improvement! https://www.investopedia.com/terms/t/technicalanalysis.asp

Cons of Using Templates

Those handy trading journal templates can be tempting, right? But think about it – manually logging every trade takes time and opens the door for errors, which makes really digging into your performance tough. And often, they’re not very flexible; a template might not quite match your unique approach or what you’re trying to achieve. That lack of customization can slow things down. Plus, automated reports are usually missing, so you’ll be doing extra work just to get some insights. For better results and smoother tracking, consider trading journal software. Curious about the advantages? Check out Investopedia’s guide on trading journals. Let’s level up your trade analysis!

Time-Consuming Data Entry

Dealing with data entry can be a real time drain, right? Think about it – lots of information, different formats, and the possibility of mistakes all add up. This takes traders away from what truly matters: analyzing markets and developing winning strategies. Just imagine spending hours each week manually entering 50 trades! Automating or streamlining data entry is a smart move to boost productivity; check out some helpful tips here.

Limited Analytical Capabilities

While I’m great at processing information and giving you summaries, really digging into complex analyses still presents a hurdle. Predicting market trends or grasping those subtle shifts in feeling? That’s tough for me! Interpreting fuzzy data and drawing solid conclusions from what’s missing also proves tricky – accurate predictions often benefit from human intuition.

I tend to spot patterns rather than really critical evaluation and figuring out cause-and-effect. So, offering investment advice or judging trading strategies isn’t something I can do; a good trading journal requires that extra level of thoughtful analysis.

Potential for Inconsistency and Errors

Keeping a trading journal by hand? It can be tougher than you think! Even small data entry mistakes pop up surprisingly often, especially if you trade frequently. And let’s face it, our thinking about trades evolves – that can lead to inconsistent records and make analyzing your performance a real challenge. To help with this, consider using structured fields or software; automation really promotes consistency. Don’t forget regular reviews!

The Software Solution: Dedicated Trading Journal Platforms

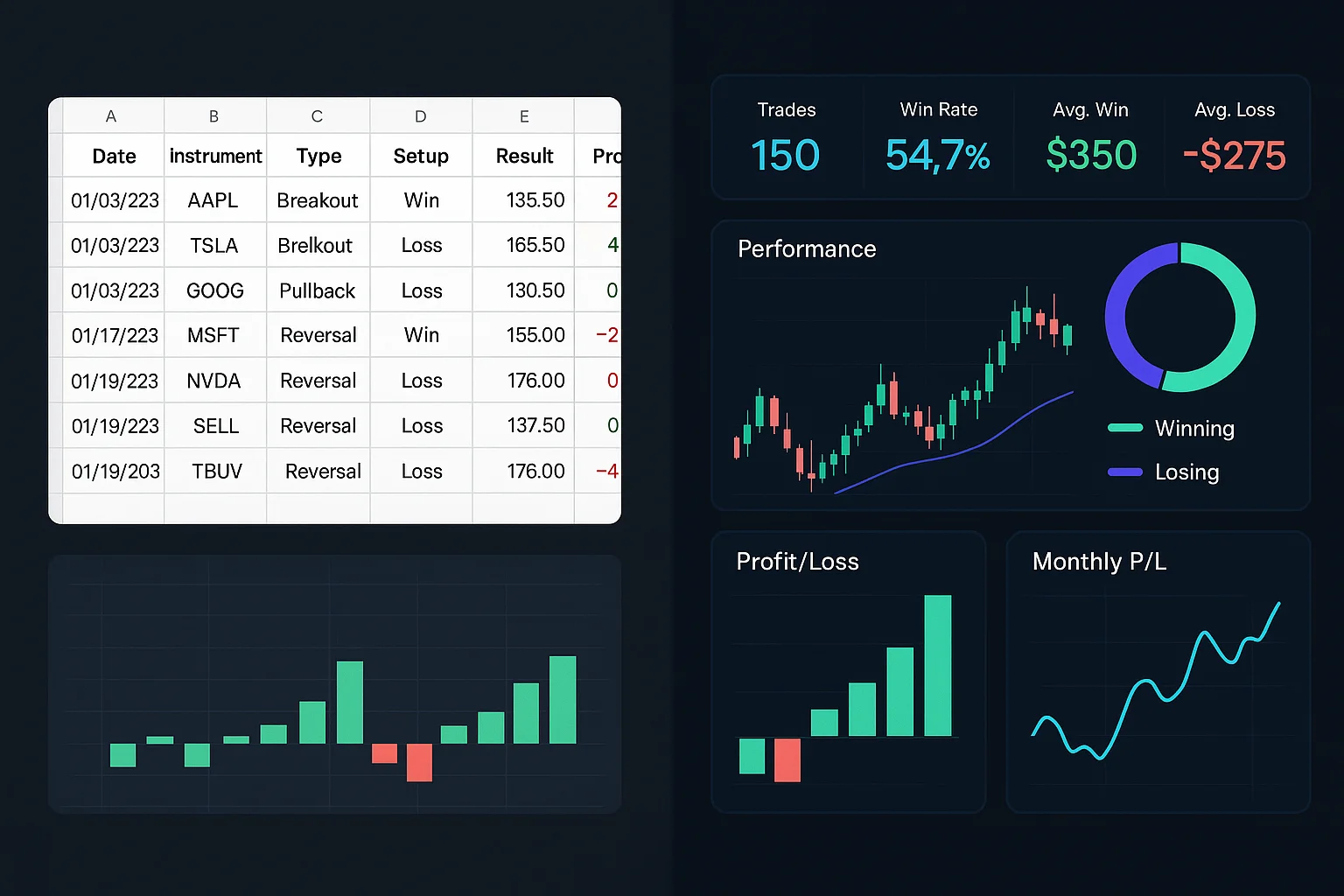

If you’re a serious trader, you know how important it is to keep track of everything. Moving beyond spreadsheets or manual notes, dedicated trading journal software can really level up your game. These platforms automatically pull trade data straight from your broker – talk about saving time and avoiding those pesky errors! You’ll discover some seriously useful key features, like detailed logging, performance analysis (think win rates and profit factors!), and reports you can customize to review your strategies with ease.

Tools like TraderSync, Journaly, and TradeLog do more than just record trades; they allow for backtesting and planning. You can even tag trades based on market conditions or news events. Ultimately, a trading journal turns all that raw data into insights you can actually use – helping you make smarter decisions and boost your trading performance.

Pros of Using Trading Journal Software

Keeping tabs on your trades shouldn’t feel like extra work! Trading journal software really streamlines the process – think of it as easily reviewing past decisions to spot those familiar patterns you might otherwise miss. It’s a great way to analyze what works and what doesn’t, helping you refine your strategy and make smarter choices down the road. Essentially, it acts like a personal coach, pointing out both your strengths and areas where you could improve – all with the goal of boosting your profitability.

Automated Data Capture (Brokerage Integration)

Wouldn’t it be great to ditch the tedious task of manually entering every trade? Automated data capture, thanks to brokerage integration, really simplifies trade journaling. Think about it – your transaction details import directly from your broker! This cuts down on those pesky errors, improves accuracy, and gives you more time to focus on analyzing your strategies—a huge advantage when using a trading journal.

Powerful Analytics & Visualization Tools

Ever feel overwhelmed by raw trading data? Our analytics and visualization tools make sense of it all, transforming those numbers into clear, actionable insights. Think of our dashboards as your personal guide – they reveal trends and patterns so you can optimize strategies and confidently make informed decisions. Plus, features like drag-and-drop report building and a handy trading journal really elevate your analysis.

Backtesting and Performance Reporting

Evaluating trading strategies? Backtesting—simulating historical trades—is absolutely crucial! It gives you a feel for potential profits and risks involved. Key metrics, such as the Sharpe ratio and maximum drawdown, provide valuable insights into performance. Don’t forget transparent reporting; while past results are helpful, they don’t promise future wins. Keeping a trading journal can really help track your progress along the way.

Mobile Accessibility

Mobile accessibility truly matters for inclusive design – it’s about creating a welcoming online space for everyone. Focusing on responsive design means your website will look fantastic no matter the device someone uses. Don’t forget to test with screen readers and make sure buttons are easy to tap! A great mobile experience benefits all users, really. You can even use a trading journal template to keep track of improvements.

Cons of Using Trading Journal Software

Thinking about trading journal software? It’s fantastic for tracking progress, but let’s be realistic – there are a few things to keep in mind too. Setting it up initially can take a little effort, similar to learning any new tool. Plus, those subscription costs add up over time, and once you pick a platform, moving elsewhere might not be simple. Some traders miss the personal touch of pen and paper, and occasionally, tech glitches pop up. Weighing these points against all the benefits is key before making your choice!

Cost (Subscription Fees)

Finding the right trading journal software shouldn’t break the bank! We offer tiered subscription plans to suit every trader’s needs. Our ‘Basic’ plan kicks off at just $9.99 a month and gives you all the essential journaling tools. Want more? The ‘Pro’ plan, priced at $24.99, unlocks advanced analytics and custom reports—think of it as having your own personal trading analyst! And for ultimate insights, Premium ($49.99) provides unlimited data storage plus priority support.

Learning Curve and Feature Overload

Beginning a new trading journal can feel a little daunting – totally understandable! At first, all those features might seem like a lot, but we’ve built our platform to showcase the most useful tracking tools while still providing advanced options if you need them. To make things smoother, we offer simple tutorials and helpful resources. Ultimately, finding the right trading journal template or software is about what suits your style best.

Potential Dependence on Third-Party Services

We’ve built our trading journal with some fantastic third-party services to help things run smoothly. Google Cloud handles the heavy lifting of our infrastructure, while Stripe keeps payments secure—a real peace of mind! Plus, a data analytics platform lets us keep an eye on performance. Of course, relying on external providers means we need to be aware of potential disruptions like outages that could affect everyone.

Template vs. Software: A Detailed Comparison Table

Choosing between a trading journal template and dedicated trading software can be tricky! Think of templates as pre-built spreadsheets or Word documents – they offer a framework for manually logging your trades. They’re great if you’re watching your budget and like to personalize things, though entering all that data by hand takes time, and analysis is limited. Trading software, however, is much more dynamic; it automatically records your trades, calculates key performance metrics, and often includes helpful charts and graphs. That automation really saves you time and gives you a deeper look at your trading habits.

A quick comparison – looking at things like Initial Cost, Data Entry Effort, Analytical Capabilities, Customization Options, and Scalability – can be super useful. Templates are perfect when you’re just starting out or need simple tracking, while software is a game-changer for serious traders who want in-depth analysis and automated processes. Ultimately, it boils down to what works best for you.

Key Features Compared (Cost, Automation, Analytics, Customization)

Finding the right trading journal can really make a difference in your progress! Our software is designed to help you grow consistently, offering powerful analytics and customization options that many simpler templates just don’t have. While there’s an initial investment, the automation features save you so much time on manual data entry – it’s worth it! We go beyond basic reporting; think detailed performance insights to fine-tune your strategies.

Here’s a glimpse of what we offer:

- Cost: Subscriptions provide ongoing value instead of just a one-time fee.

- Automation: Data logging and calculations are handled automatically.

- Analytics: Advanced charting and statistical analysis come standard.

- Customization: Tailor fields, alerts, and reports to perfectly fit your trading style.

Visual Representation of Differences

Addressing Common Concerns & Objections

It’s really important to tackle those common concerns and objections head-on if you want successful sales and build solid customer relationships, right? Showing that you anticipate potential doubts demonstrates genuine understanding – a little empathy goes a long way! For example, if someone’s worried about the time commitment of keeping a trading journal, it’s fair to acknowledge that it might seem like a lot initially. Then, provide clear answers and back them up with solid evidence. You could explain how consistently using a trading journal, whether you use a handy template or dedicated trading journal software, can actually save time while significantly improving your trading results. Think of objections not as roadblocks, but as opportunities to really highlight the value – demonstrating how your chosen method leads to smarter decisions and increased profitability.

"I Don't Have Time to Journal" - Strategies for Efficiency

It’s easy for traders to feel squeezed for time, but journaling doesn’t have to be a huge commitment! Really, short, focused entries are the way to go. Just jotting down a few sentences about why you made a trade and how it turned out can offer surprising insights. Consider prioritizing actionable strategies – often, lengthy explanations don’t add much value.

Batching Journaling Sessions

Want to level up your trading? Batching journaling sessions is a surprisingly effective trick! Instead of jotting down notes whenever you can, try scheduling dedicated blocks – maybe an hour twice a week. This focused approach lets you really dig into your trading journal, spotting patterns and gaining deeper insights, similar to how concentrated work improves results.

Utilizing Voice-to-Text Tools

Traders, ever wish you could jot down those market observations faster? Voice-to-text tools can be a game-changer! Getting clear dictation is key – try to cut out filler words like ‘um’ and ‘ah.’ You’ll find options everywhere, from specialized software such as Dragon NaturallySpeaking to built-in features in programs like Google Docs or Microsoft Word. Remember, while voice input boosts drafting speed, careful editing and proofreading are essential for accurate trading journal entries; consistent practice really does improve both your speed and the quality of your notes.

"Software is Too Complicated" – Finding the Right Fit

It’s easy to feel lost when faced with so much trading software, isn’t it? So many features can be overwhelming! When picking tools, prioritizing simplicity and usability really makes a difference. A generic solution rarely works best; instead, consider what aligns with your individual trading style. Do you need something straightforward like a trading journal template, or perhaps more in-depth analytics? Taking a look at your current workflow can help you find the perfect fit and ultimately boost your efficiency. Ready to streamline your trades?

Starting with a Free Trial or Basic Plan

Excited to explore our trading journal software? Why not kick things off with a free trial – it’s the perfect way to see what it can do and understand any limitations, like data storage. Getting started is super easy; simply create an account and begin logging your trades immediately! As your trading evolves, consider upgrading to our basic plan for even more powerful analysis tools.

Choosing the Right Option: Matching Journals to Trader Profiles

Finding the right trading journal is key to leveling up your skills – think of it as picking out the perfect notebook! What works best really depends on you; different traders have different needs. If you’re just starting, a simple template that lets you record entry and exit prices, plus why you made those moves, can be fantastic. Now, if you’re a day trader constantly reacting to what’s happening in the market, software with real-time data integration and quick note-taking features is incredibly helpful. Swing traders, focusing on longer trends, might appreciate journals loaded with charting tools for deeper analysis.

Ultimately, your trading strategy should be your guide. Look for something user-friendly that lets you customize it to track what you find most important. Whether it’s a basic template or advanced software, consistent journaling will definitely boost your self-awareness and help refine those trading decisions.

Beginner Traders: Simplicity and Consistency are Key

Starting out as a beginner trader? Simplicity and consistency are often the keys! Rather than jumping into complicated strategies, it’s usually best to really nail down the fundamentals – kind of like learning to ride a bike before trying any fancy tricks. A trading journal can be incredibly helpful for keeping tabs on your progress. Slow and steady wins the race; building a strong foundation is what matters most.

And don’t forget about risk management! Always use stop-loss orders, and stick to the plan you’ve created. Regularly reviewing your trades in that trading journal can reveal patterns and ultimately lead to long-term success.

Intermediate Traders: Balancing Manual Control & Automated Analysis

Intermediate traders often find success by blending their own judgment with the power of automated tools. Smartly integrating software – like programs for backtesting or identifying trends – can be really useful, but it’s still important to stay alert and ready to react to those little market changes that algorithms might miss. This balance helps maximize both efficiency and adaptability.

It’s tempting to lean too heavily on automation, though! That’s why human oversight is key. Keeping a trading journal can be incredibly helpful; it lets you track your results and fine-tune your strategies, no matter if they’re automated or done manually. Think of technology as a supportive assistant – it should boost your skills, not take over entirely.

Advanced Traders: Leveraging Powerful Analytics for Optimization

Leveling Up Your Trading Through Journaling (Regardless of Method)

Seriously, if you’re hoping to become a consistently successful trader – whether you’re day trading or investing for the long haul – keeping a trading journal is absolutely key. It’s like having a personal coach; it lets you take a good look at what you’re actually doing in the markets. You start noticing patterns, both the wins and the mistakes, which helps you tweak your strategies as you go. Don’t worry about documenting every tiny detail – it’s more about understanding the reasoning behind your choices and what you learned from each trade.

And don’t stress too much about finding the perfect trading journal template. The real win is just using one consistently! A simple notebook works, or maybe a spreadsheet, or even dedicated software. Pick whatever feels right for you and stick with it; the long-term value of regular review far outweighs any minor inconvenience.

Regularly Reviewing Past Trades

Want to level up your trading? Regularly looking back at past trades can really make a difference! Keeping a trading journal – whether it’s a basic spreadsheet or specialized software – lets you analyze your decisions without the emotion. It’s amazing how spotting patterns and understanding what went right (and wrong) leads to smarter choices down the road.

Make sure you jot down exactly when you got in and out of trades, and why. Pinpointing those recurring mistakes? That’s key to refining your strategy and boosting profits.

Identifying Recurring Patterns and Biases

Recognizing patterns and biases is key to making good choices. Really, taking a look at data – whether it’s from a trading journal or somewhere else – can show you predictable trends. It’s helpful to try observing things objectively; don’t just go with your initial gut reaction. Instead, dig deeper to find what’s really going on. For example, consistently reacting the same way to certain news might point to a bias. And remember, correlation isn’t causation – just because two events happen together doesn’t mean one caused the other! Keeping a detailed trading journal makes this kind of analysis much simpler and can seriously improve your trading strategy.

Adapting Strategies Based on Performance Data

Knowing your marketing ROI really comes down to tweaking what you do based on how things are performing. It’s helpful to regularly check those key numbers – like click-through rates and how much it costs to get a customer – so you can spot areas needing attention. Those actionable insights let you make smart changes, ensuring your resources go where they’re most effective. For example, if an ad isn’t cutting it, try testing different versions! A 15% jump in conversions? That’s definitely worth keeping up. Keeping a trading journal of these adjustments is invaluable for continuous growth – why not start tracking your results today?

Continue learning in the Trading Journal Academy

This article compares trading journal templates and dedicated software to help you choose the right approach.

To see how this decision fits into a complete journaling workflow, start with the main guide below.

→ Trading Journal Academy Hub

A structured reference covering journaling, analysis, psychology, and tools.

Related articles

Start a trading journal

How to set up a journaling process that matches your trading activity.Trade analysis explained

Why structure and consistency matter when reviewing trades.10 common trading journal mistakes

Issues that often appear when journaling systems don’t scale.

Apply these concepts with Flows

Templates can work at first, but they often become harder to maintain as trading activity grows.

Flows combines the flexibility of templates with the reliability of dedicated software by automating data collection while preserving full manual control.

With Flows, you can:

automatically import trades from multiple brokers and accounts,

manage multiple portfolios and strategies in a single journal,

manually edit, annotate, and enrich trades,

keep a consistent structure without maintaining spreadsheets.

Because journaling, analysis, and review tools are fully integrated, Flows removes the trade-offs between flexibility and scalability.

→ Trading Journal feature

→ Trading Journal documentation

Further reading

For a broader, neutral discussion on trade logs, journaling methods, and analysis tools, you may also refer to:

→ Investopedia – Trading Journal