Trading Journal: Your Guide to Tracking & Improving Performance

Table of Contents

Why Traders Need a Trading Journal

For any trader hoping to level up their game and see consistent profits, a trading journal is honestly invaluable. It’s so much more than just jotting down whether you won or lost; it’s about creating a detailed log of why you made each decision, the strategies you used, and even how you were feeling at the time. Really digging into these entries can reveal surprising patterns – both good habits and ones that might be holding you back. That kind of self-awareness is key to thriving in trading’s often unpredictable world.

Think of it like a detective solving a mystery! A trading journal helps you uncover clues about your own trading behavior, leading to better choices and less impulsive actions. You’ll gain clarity on what truly works, analyze past mistakes, refine your approach, and ultimately boost your returns. Here’s how: 1. Document the reasoning behind each trade. 2. Pay attention to emotional influences. 3. Look for recurring patterns. Why not start journaling today? It’s a worthwhile investment in your trading journey!

The Problem: Emotional Trading & Inconsistent Results

Emotional trading? It’s something many face! When fear or greed take over, it’s easy to abandon a well-thought-out plan and make impulsive choices that can really hurt results. Recognizing those emotional triggers is the first step toward improvement – are you chasing wins after a good trade, or maybe panicking when things go south? A trading journal proves incredibly helpful for spotting these patterns. Ultimately, consistent profitability hinges on discipline; minimizing emotions and sticking to your strategy.

Common Pitfalls for Traders

It’s common for traders to struggle with consistency – we’ve all been there! Emotional trading, driven by fear or excitement, can lead to quick decisions and unexpected losses, like jumping on news headlines without thinking. Without a solid strategy and risk management, things can easily spiral out of control. Keeping a trading journal is incredibly helpful for identifying these patterns.

Relying solely on gut feelings instead of market analysis? That’s a gamble. And chasing profits without stop-loss orders puts your capital at unnecessary risk. Regularly reviewing your performance – documented in your trading journal, of course – allows you to make smart adjustments and improve your results.

How Lack of Self-Awareness Hurts Performance

It’s tough when we’re not quite sure what we’re good at or where we need to improve, right? A lack of self-awareness can definitely limit our potential, making it harder to make smart decisions and even accept helpful feedback. Consider a trader swayed by emotions – that illustrates the point! Consistent self-reflection is key; it allows us to learn and adapt, ultimately leading to better results in just about anything we do.

What is a Trading Journal? (And What It Isn't)

Keeping a trading journal can really transform how you approach the market – it’s like having a personal coach right there with you! It’s about more than just noting wins and losses; think of recording why you made those decisions, even what emotions were swirling around. Unlike simple spreadsheets, a trading journal digs into your thought process, helping you identify patterns and refine strategies. Taking the time to review these entries regularly unlocks valuable insights into where you excel and areas for improvement. So, why not start building yours today? It’s a fantastic way to track trades and reach your full potential!

Defining the Purpose of a Journal

Think of a trading journal as your own personal mentor for navigating the markets! It’s essentially where you jot down your trading choices and how they played out—a great way to understand why you make those decisions. Keeping detailed records can highlight patterns in your performance, allowing for honest self-evaluation and steady growth. Journaling also encourages reflection on market psychology, helping you pinpoint strengths and weaknesses that ultimately boost profitability.

Beyond Just Recording Trades - A Tool for Analysis

Keeping a trading journal isn’t just about recording your trades—it’s actually a fantastic way to analyze your performance. Taking the time to review those detailed entries can really help you spot patterns and understand what strategies are truly working for you. It’s essential for consistent growth, don’t you think? Plus, things like win-rate analysis offer valuable insights that let you refine your approach.

Benefits of Keeping a Trading Journal

Whether you’re a seasoned pro or just starting out, keeping a trading journal is an absolute game-changer. Seriously! Imagine it as your own personal record – jotting down every trade, when you jumped in and out, and the reasons behind those decisions. Don’t forget to note how you were feeling too; that’s surprisingly important. This consistent tracking gives you powerful data for honest reflection, helping you uncover patterns and identify where things might be going wrong.

It really does empower you to refine your strategies and ultimately improve your profitability. Here’s a glimpse of what it offers:

- Analyzing past trades highlights both your strengths and weaknesses.

- It lets you evaluate objectively, cutting through emotional reactions.

- Improved risk management is within reach when you recognize repeating patterns.

- Keep an eye on trade psychology – acknowledge those feelings of fear and greed.

- Pinpoint profitable setups consistently.

- Optimize your trading plan for maximum efficiency.

Identifying Patterns in Your Trading Behavior

Really wanting to level up your trading? It all starts with understanding your trading behavior. A simple way to do that is by keeping a trading journal – it’s like having an honest, outside perspective on your decisions. Jot down the details of each trade; what did you actually do, and why? Noting patterns in things like entry and exit strategies can be incredibly insightful.

Analyzing these entries reveals both where you shine and areas needing attention, letting you fine-tune your approach based on data. Want to learn more about journaling techniques? Check this out: https://www.investopedia.com/trading-journal-5072413.

Recognizing Recurring Mistakes

Want to level up your trading? A trading journal is a fantastic tool! It’s all about tracking each trade, noting what went right and, importantly, spotting those recurring errors – maybe you’re forgetting stop-loss orders. Jot down the details: what happened, what you did, and the outcome. Clear notes really help solidify your understanding. Check out some helpful journaling tips here.

Spotting Successful Strategies

Spotting successful strategies often involves recognizing patterns—they naturally evolve with market shifts! Truly effective approaches focus on disciplined risk management and clear entry/exit rules, moving past pure chance. Building repeatable processes is vital for consistent results. Keeping detailed records and regularly analyzing your performance – think of it like a trading journal – helps you fine-tune your approach. https://www.investopedia.com/articles/active-trading/092315/importance-trading-journal.asp offers more insights.

Improving Discipline and Emotional Control

Discipline and emotional control are truly vital for consistent success in trading. Small, actionable steps—like setting clear goals and prioritizing your time—can significantly improve self-discipline. Think of regularly reviewing your performance as checking progress on a journey; it helps you refine your approach to the markets.

And when it comes to emotions? Understanding what triggers them is key, alongside techniques like deep breathing or quick breaks. Consistent journaling—essentially, keeping a trading diary—provides valuable insights into how you react emotionally and ultimately leads to smarter decisions.

The Power of Accountability

Successful teams thrive on accountability – it’s really the foundation! Think of it like everyone owning their part of a puzzle, which naturally boosts performance. A culture embracing this fosters trust and encourages proactive problem-solving; vital for consistent trading results. To build it, clearly define expectations and regularly check in. Open communication and celebrating successes are key, and keeping a detailed trading journal is a great way to track progress.

Managing Fear, Greed, and Hope

Consistent trading success often hinges on managing those tricky emotions – fear, greed, and hope! It’s easy for fear to make us miss out on good opportunities, while greed can push us into risky bets. And too much hope? That can really cloud our judgment. Keeping a trading journal is incredibly helpful; it provides data so you can objectively review past decisions and refine your strategy.

Enhancing Risk Management

Truly lasting trading success? It all comes down to smart risk management. Being proactive about spotting and minimizing potential losses is absolutely key – think stop-loss orders, diversifying what you hold, and regularly checking how things are going. Don’t forget understanding your comfort level with risk! Keeping a detailed trading journal, noting why you entered and exited each trade, can be incredibly valuable for continuous improvement. Start journaling now; it’s an invaluable tool to sharpen your risk management skills!

Analyzing Risk-Reward Ratios

Making smart decisions often comes down to analyzing risk-reward ratios – it’s really just comparing potential gains with possible losses, a pretty straightforward calculation! A favorable ratio, like 2:1 or better, suggests the reward looks promising relative to the risk. For instance, risking $100 for a chance at gaining $300 creates a solid 3:1 ratio. Consistent evaluation using this method can help traders manage their funds and boost profits; understanding these ratios is truly key.

Learning from Losses to Minimize Future Risks

It’s really important to learn from past trading experiences – that’s how we minimize future risks! Keeping a trading journal can be surprisingly helpful; it lets you see those recurring patterns and pinpoint where your strategy might be falling short, perhaps noticing losses with specific stocks. Armed with these insights, you can make smart adjustments, like using stop-loss orders or diversifying. Regular journaling really encourages continuous growth toward consistent profitability.

How to Create Your Trading Journal: A Practical Guide

Want to level up your trading game? Creating a trading journal is seriously one of the best things you can do! It’s like having a personal coach, helping you spot what works and where you might be stumbling. Setting one up doesn’t have to be complicated – whether it’s a simple notebook, a spreadsheet, or some fancy software, find something that clicks with your style. The key is recording everything: entry and exit prices, the reasoning behind each trade, how you managed risk, and even just how you were feeling.

Regularly looking back at these entries can reveal surprising patterns and biases. A good template might include sections for trade details, market conditions, and a post-trade analysis – think about what went right, where you could have done better, and most importantly, what you learned. Keeping up with a consistent trading journal really does provide invaluable data to fine-tune your strategy and ultimately boost your profits.

Choosing the Right Format (Digital vs. Physical)

Deciding between digital and physical content really depends on your audience and what you want them to remember. Sharing PDFs or other digital options is great for reaching lots of people quickly. However, a physical copy offers something special – a tangible feeling that can make your message stick, particularly with premium products. Consider the cost, ease of distribution, and even environmental impact; digital formats are often more budget-friendly and easier to share, but physical materials still hold appeal for many.

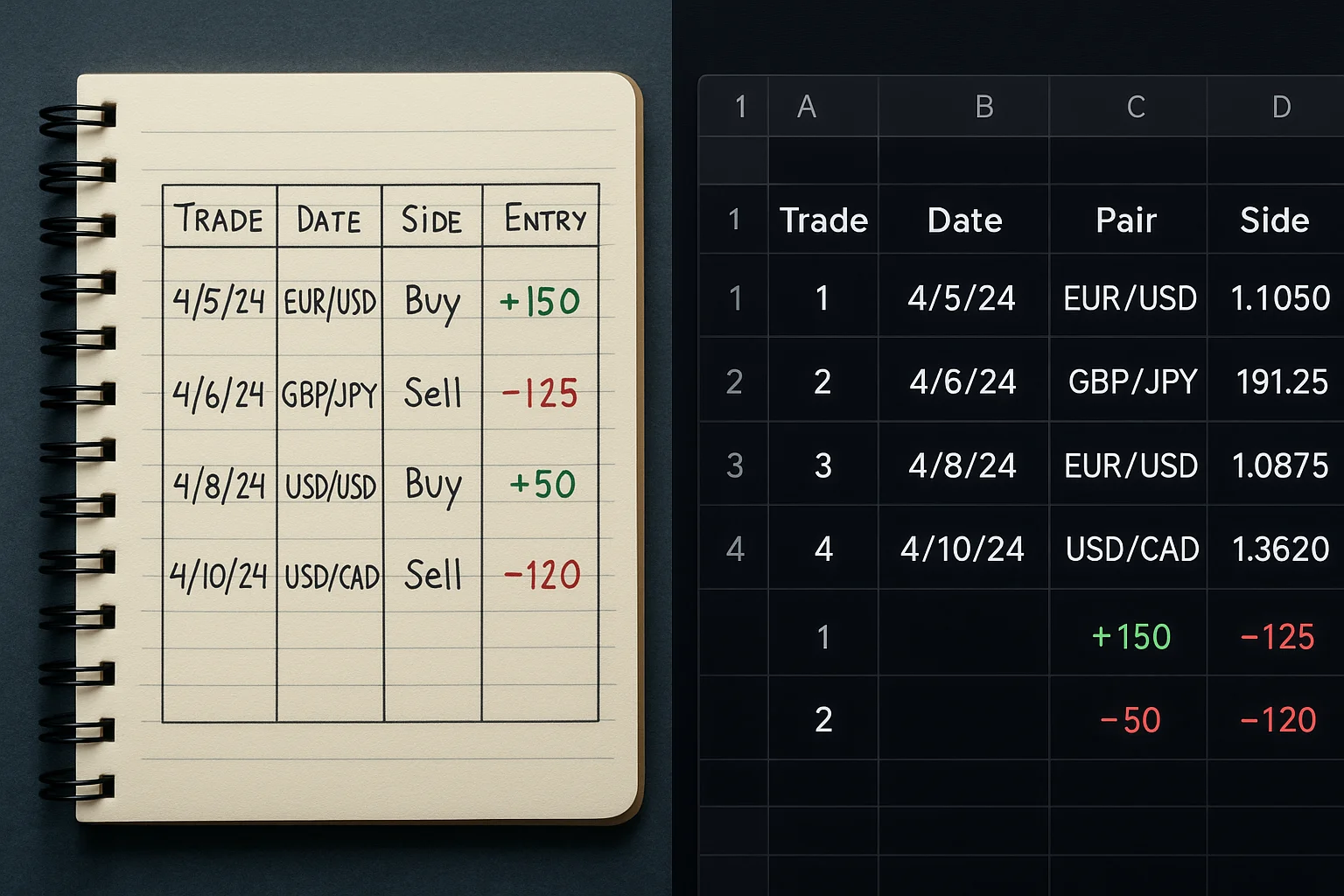

Spreadsheet Templates

Want to streamline your trading analysis? Our handy spreadsheet templates can really help with that! They offer instant value, letting you quickly track performance and identify those emerging trends. Plus, they’re downloadable and customizable—perfect for traders of all levels looking to optimize their strategies.

Think automated calculations and visual reporting, all designed to boost your decision-making.

Dedicated Journaling Software/Apps

What to Record in Your Trading Journal

Keeping a trading journal can really boost your progress over time! It’s amazing how much you learn when you actually write down each trade – it lets you see what’s working and spot those patterns in your trading style. Don’t just focus on whether you made money or lost it; think about why you entered or exited a position. Really detailed notes are best, so ditch the vague comments about the market and get specific!

Essential Information: Entry & Exit Details

Success in trading often hinges on knowing precisely when to jump in and out of positions! A trading journal acts like your personal memory bank – a place to log the details of every trade. Jot down entry and exit times, prices, and what sparked those decisions, whether they were part of a plan or just a gut feeling. Regular tracking can reveal valuable patterns, helping you fine-tune strategies for better results.

Beyond the Basics: Emotions, Market Conditions, and Rationale

Making smart investment decisions isn’t just about crunching numbers—emotions often play a role! Fear and greed can lead to impulsive choices, so keeping a trading journal is incredibly helpful. It lets you track those feelings alongside market data, providing valuable insights later on. Plus, staying aware of broader trends and economic news really matters. Documenting the rationale behind each trade—your initial thinking—creates a fantastic learning tool for consistent growth.

Adding Context: News Events, Economic Data

Strong market analysis really benefits from context—it just makes everything clearer! Think about weaving in relevant news and economic data; it gives a much broader perspective, strengthening your trading arguments with real-world influences. For example, mentioning recent inflation reports or shifts in global politics can add significant weight to your assessment. And of course, always cite sources accurately while keeping the focus on what truly matters.

Maintaining a Consistent Journaling Habit

Developing a consistent trading journal habit is really key to seeing improvement over time. Don’t feel like you need hours – even just five minutes each day can make a surprising difference! If fitting it into your schedule feels tricky, try blocking out specific times and setting reminders. Plus, having an accountability partner can be super helpful. Remember, making steady progress is far better than aiming for perfect entries every single time.

Setting Realistic Goals

Consistent trading success really comes down to setting goals you can actually reach. The SMART method – Specific, Measurable, Achievable, Relevant, and Time-bound – provides a great way to define those objectives clearly. Think of it like climbing stairs; break down big dreams into smaller steps! Don’t forget to anticipate challenges and plan ahead; proactive planning can save you later on. Plus, keeping a detailed trading journal is super helpful for tracking your progress and tweaking your approach.

Reviewing Your Journal Regularly (Weekly/Monthly)

Want to level up your trading game? Regularly reviewing your trading journal is key! It’s like looking back at a match – figuring out why you made those choices and what they meant. This kind of reflection helps you honestly assess yourself, so you can tweak your strategy accordingly. A quick weekly check-in with your trading journal can bring big long-term gains.

Continue learning in the Trading Journal Academy

This article explains the foundations of what a trading journal is.

To understand how journaling fits into a complete trading process, start with the main guide below.

→ Trading Journal Academy Hub

A complete, structured guide covering process, analysis, psychology, and tools.

Related articles

How to start a trading journal

Practical steps to build a journal you can maintain consistently.Benefits of keeping a trading journal

Why journaling improves decision-making over time, beyond profits and losses.Trade analysis explained

How to review trades objectively and extract actionable insights.

Apply these concepts with Flows

These concepts explain how a trading journal should work in theory.

Flows helps apply them automatically and consistently in real trading conditions.Automatic trade import from multiple brokers and accounts

Support for multiple portfolios and strategies

Manual editing, notes, and annotations

Integrated analysis and review workflow

Further reading

For a neutral, external definition of trading journals and trade logs, you can also refer to:

→ Investopedia – Trading Journal

Ready to take action?

Track your trades and improve your strategy with flows.trading’s integrated journaling feature.